A spend management software brings control, visibility, compliance, and documentation to help businesses reduce costs, avoid unnecessary spending, and pay vendors or employees on time.

Businesses assign a budget for several activities like insurance, capital equipment, and inventory resupply. However, budget leaks damage your company’s profit margins when the spending stays unsupervised.

Moreover, when the business scales up, such issues will also grow in volume challenging your business profitability. Therefore, businesses of all sizes use a spend management tool to keep an eye on the money going out and keep it within the company budget.

What Is Spend Management?

Spend management is the process of managing all business purchases and supplier payments. The primary goal is to account for every dollar going out from the company account and get the best value.

Spend management policies should automate and integrate all spend-linked activities from source to vendor settlement. Such granular practice should ensure procurement goes as planned by the business stakeholders. Additionally, it enforces payment to vendors, contractors, and other third parties through the contract compliance process.

Importance of Spend Management

The standard spend management activities offer the following advantages:

- Business efficiency by automating spend and expense tracking processes that are error-prone and tedious if delegated to employees.

- Reduce risks and costs since the tool tells you about the product being procured, the vendor’s name, and the cost associated with the procurement.

- Better collaboration between business resources and third parties is achievable when you follow a standard spend management process along with a digital app.

- Sustainable productivity improvements by releasing employees from mundane work and letting them complete tasks that earn revenue for your company.

The followings are the best spend management tools that enable you to bring all spending under your management and get the best value for the money you spend:

Airbase

Airbase is a comprehensive spend management tool for different types of businesses, like early-stage companies, small businesses, mid-market companies, pre-IPO businesses, and enterprises. It offers a bunch of advanced spend control, auditing, and oversight solutions.

For example, the Receipt Management module offers enforcement of compliance, effortless receipt attachment, dedicated emails, sharing receipts from another device, etc. Also, there are Security and Fraud Detection module to enable card control, card limits, card blocking, fraud detection, fraud notification, encrypted sharing of virtual card details, etc.

Spendesk

Spendesk has many helpful and intuitive features, including integrations and Optical Character Recognition (OCR). With this tool, your company can automate all the recurring expenses. Moreover, it’s powerful enough to match expense claims to the respective invoice and save time.

Spendesk is also a flexible tool so that companies can customize it according to their spend management approaches. For example, you assign debit cards for specific spending to individual staff. In addition, you may also assign virtual credit cards for single-use purposes.

Additionally, it offers push notifications for payment validation, accounting tool integration, a point-in-time overview of expenses, and a comprehensive spend overview dashboard.

Coupa

Coupa is another popular tool for business spend management (BSM) with cloud access. It can manage spending across various business verticals like payments, supply chains, procurement, treasury, etc. There are three stacks of tools for convenient spend management.

The first stack of tools is the Applications. This stack covers all the essential modules like procure, invoice, expense, pay, contract management, strategic sourcing, spend analysis, etc.

The 2nd stack is the BSM platform that focuses on user privacy, profile, data security, and integrations. It includes a connected core, cloud access, integrations, graphical user interface (GUI), etc.

And lastly, the 3rd stack is the Coupa business community. It offers features like an open business network, Coupa advantage, and community AI.

Emburse

Emburse offers complete tools for spending management for startups to big multinational companies. Its solutions include expenses management, accounts payable, purchasing automation, streamlined payment system, audit, travel management, and data dashboards.

It also has an automatic tool to help businesses decide which solution is suitable for their operation for extra savings. Furthermore, it has tailored suits by industries like accounting, consulting, healthcare, legal, engineering, etc.

The best thing is Emburse’s modular approach for business spend management, depending on company size. For example, Emburse Spend for small businesses, Spend for mid-sized companies, and Chrome River for enterprises.

Mesh Payments

Mesh Payments is yet another software that you can use and stop spending leakages. First off, its Spend Insights functionality brings you valuable data insights just when you need them. Whenever you view a spend item, its mobile app automatically shows savings opportunities in the future, spend forecasting at the present rate, etc.

Secondly, its Spend Controls module gets you real-time payment request alerts, lets you limit spend, cancel subscriptions from one central interface, and block vendor payments with a single click. Other notable features are Spend Optimization, Real-Time Reporting, and Automated Payment workflow.

Ramp

Ramp has divided its business spend management system into 4 mega modules: Start, Scale, Streamline, and Save. The Start module gives you access to tools to manage several cards, bill payments (ACH/checks/cards), real-time expense tracking, and accurate spend accounting.

Scale module enables you to enforce business policies around spending and expenses. For example, you can use expense policies to set rules and spend controls to enforce these spending guidelines.

Streamline module offers you several workflows (Onboarding, Collaboration, and Accounting) to automate spend management and integrate (1000 integrations) it with other business tools. Lastly, the Save module is there to cater to your needs for receipt matching, expense categorization, price intelligence, savings insights, etc.

Brex

Brex is all about speeding up business operations finances while complying with the company policies for spends and expenses. By enabling the employee to submit accurate expenses and the accounting team to audit the expenses effortlessly, Brex develops a culture of financial discipline among the company and its human resource.

Brex currently offers various company expense managing solutions like credit cards, business accounts, expense tracking, integrations, etc. It’s also bringing the spend management feature for the Brex Empower subscription.

Workday

Workday, the renowned human capital management tool, also started offering simple and strategic ways to manage business spends. It comes with an intuitive, simple, and lightweight graphical user interface for spend management from one centralized platform.

Its UI has 3 basic tabs: Source to Pay, Inventory, and KPIs. The Source to Pay module gives valuable data insights on Supplier Spends, Managed vs. Unmanaged Spend, Supplier performance, Invoice Processing, etc. Moreover, it’s a cloud-based app so that you and your business stakeholders can keep an eye on company spend from any device and anywhere with an internet connection.

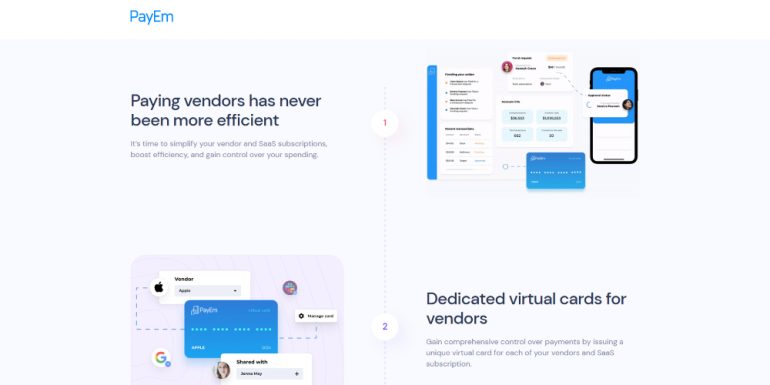

PayEm

PayEm is all about advanced automation in the spend management vertical of your business. It brings vendor subscriptions and SaaS subscriptions for employees in one place. Thus, you don’t need to buy separate software for different spend heads.

On PayEm, you can create and issue virtual credit cards for different third-party vendors and assign a point of contact person for spend management. You can also apply the same strategy to software subscriptions.

Moreover, you get the ultimate spend control authority on PayEm. Thus, you can stop overspending on software subscriptions by removing unnecessary apps or former employee accounts from existing apps.

Teampay

Teampay’s cloud-based app puts the finance teams in the driver’s seat so that they can visualize all the spends from different verticals of your business. Company stakeholders also get a real-time view of everyday spending and can make quick spend limitations if needed.

It also offers a conversational UI so that employees can get real-time assistance from the finance team to know the buying process or get transaction approvals. Moreover, you don’t need to wait for the next month’s bill to understand how your employees are spending. You’ll get real-time data on current spending.

JAGGAER ONE

JAGGAER ONE is also a popular name for Source-to-Pay activities that brings all spends from different verticals into one place for easy supervision of company expenditures. Its thoughtfully designed app enables you to manage indirect and direct expenses from one simple tool.

It offers highly advanced data analytics and insights by combining AI and Robotic Process Automation (RPA). Thus, you can get actionable data to restructure the spend management process, like creating a procurement catalog for the entire business.

RealPage

RealPage helps you become cost-efficient and productive when you manage vendors, invoices, and purchases on this tool. It’s not just a mere spend tracking tool.

It gathers spending and earning data of all the business portfolios of your company and offers you data insights for smart procurement. Moreover, it helps you automate all purchase orders (POs) and their approval processes with real-time data feed to a central dashboard for spend oversight and analysis.

Concur Expense

Concur Expense is a spend management offering from SAP, the renowned business operations ERP software developer. The product helps you integrate and automate business spend management by linking several Source-to-Pay transactions.

The tool is beneficial for both the employee and employer. For example, field employees can submit their expense vouchers from a mobile. Concur’s intelligent program will automatically verify the expense and send you a notification so that you can approve the spend faster.

Final Words

By utilizing a spend management software, you can plug the holes that drain money unknowingly and cushion your company for profit margin. You may also require one of the best expense trackers if your business has to reimburse recurring payments made by employees or vendors.