Geekflare is supported by our audience. We may earn affiliate commissions from buying links on this site.

Finance is a tough nut to crack for most people. You cannot be an expert at everything, and most of the time, you don’t have time to study finance independently.

With a little bit of help from the M1 Finance App, that’s not a problem anymore. The app will teach you how to invest in various ways like stocks, bonds, currencies, commodities, and real estate. It also provides instant access to top investment opportunities worldwide based on news and trends.

M1 Finance is a mobile-first investment platform that offers a new way to invest in stocks and funds without the hassle of losing money in the market. It also boasts an easy interface and intuitive layout, so it’s as easy to use as any other smartphone app. M1 Finance could be your ideal investing platform for your future endeavors.

What is M1 Finance?

M1 Finance is a financial app that helps users learn how to invest. The app is available for both iOS and Android. It provides users with tips, videos, and interactive tutorials on investing their money. It also includes investment opportunities based on news and trends across the world.

For example, if you’re looking for high-yielding stocks that are making news right now, you’ll find them listed in M1 Finance’s database of investments.

Why should you use the M1 Finance App?

This app is an excellent resource for beginners and provides a straightforward way to start investing. The app is easy to use and teaches you the basics of finance. It’s also trustworthy because top professionals in the industry back it.

The M1 Finance App has a lot of potential because it doesn’t just teach you how to invest; it also lets you know what opportunities are available in the market so that you don’t spend too much time researching on your own.

How to invest with M1 Finance App?

M1 Finance App has a few different ways that people can invest.

You can make a lump-sum investment or start investing with as little as $5 per month. It allows people to get into the financial game without worrying about breaking the bank or going into debt. The money invested through M1 Finance App is FDIC insured, so your investments are safe and secure. You can expand your portfolio by investing in stocks, bonds, commodities, and real estate.

The best part about this app is that it provides instant access to top investment opportunities through social media feeds and articles posted on their website. It’s easy for beginners and experts alike to find high-quality investment opportunities available in the market on a particular day.

M1 Finance App Features

M1 Finance App is a great resource to help you invest your money and build wealth over time. It clearly outlines how investments work and the pros and cons of each option so that you can make the right decisions. In addition, M1 Finance App features a blog that contains advice from experts in finance on investing basics like trading strategies, retirement planning, and much more.

The app offers easy-to-understand explanations of different investment theories and teaches you to invest independently. It also guides you through the process of buying and selling stocks, bonds, commodities, currencies, and more to help your portfolio grow. It is a great way to learn about investing and building your wealth.

Account Setup

First, you will need to create an account with M1 Finance App. It is a quick process that only takes a few minutes. Next, you will need to connect your bank account to the M1 Investor app.

M1 is compatible with brokerage accounts, Traditional IRA, Roth IRA, SEP IRA, custodial (M1 Plus only), and trust accounts. Remember that the minimum required to create an account is just $100 ($500 to IRAs). Once your portfolio account and banking details are in place, you’re ready to begin investing.

Goal Planning

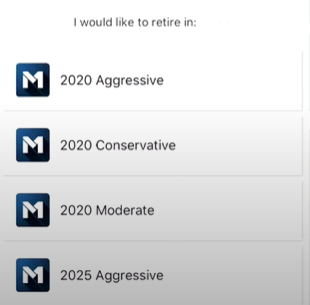

If you want to be financially successful, you must plan for your goals. M1 Finance App also provides a goal-planning tool that helps users see how much they can save and what investments will help them achieve their goals, like retirement.

You’ll be able to break down your monthly bills and see how much money you can put towards your savings plan each month. The app will also teach you about the different types of loans, mortgages, and credit cards to be better informed to make a significant financial decision.

Account Services

M1 Finance App provides an easy-to-use way to manage your financial account. You can set up two types of accounts with M1 Finance App. One is a brokerage account, which allows you to buy or sell shares of stocks and bonds, and the other is a savings account, which will enable you to save money while earning interest.

If you already have an online brokerage account, M1 Finance App will also help you automate that process. It will allow you to import your transactions from that account into M1 Finance App and continue working without manually entering them each time.

The app provides clear instructions for importing transactions so that anyone can do it in just minutes. Another benefit of using this application is that it allows people who don’t have access to writing love or a computer to use their brokerage account as any other person would.

Cost Management

If you have a tough time managing your finances, then M1 Finance App is for you. It provides all the information you need to make the best financial decisions and helps you control your money.

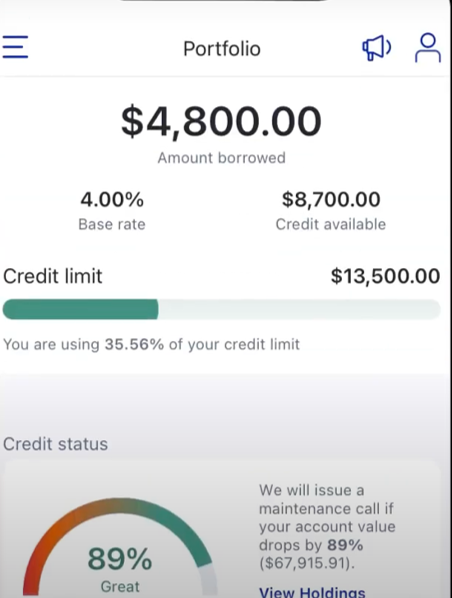

M1 Finance App also provides an easy-to-use interface that makes it easy to manage your investments. With this app, you can set up budgets, monitor spending, track investments, and more. You’ll be able to do all this without having to hire an expensive personal finance advisor or read a dry book on finance. Here’s how M1 helps you manage costs-

- M1 Spend seamlessly connects your checking account and your investments. You can transfer funds or set up a direct deposit and spend using debit cards. There’s no minimum balance, and every deposit is insured through the FDIC up to $250,000. M1 Plus members also get cashback of 1% and 1% interest and check-sending capabilities.

- Owners Rewards Credit Card is a unique credit card, a special offer available exclusively to M1 Plus members. There is no annual cost; cardholders can earn as much as 10% cashback on expenditures relating to invested companies on the platform.

- The M1’s Smart Transfers are accessible to Plus customers. They allow users to establish the rules that will allocate the extra cash to spend, the maximum amount of annual IRA contributions and investing into all your accounts with a brokerage. Rules are there to ensure that cash management is automated in a manner that meets your requirements.

Portfolio Construction

The first thing you’ll learn with M1 Finance App is constructing a portfolio. By picking the best investments for your goals, you’ll be able to achieve the best results. The app gives you three different portfolios to choose from: balanced investment, aggressive investment, or conservative investment. You can also customize these portfolios to your preferences by adding and removing assets.

It doesn’t matter if you’re interested in bonds, stocks, or currencies. The app will help you build your custom portfolio based on your needs to stay on track with what’s going on in the world of finance.

Portfolio Management

Investing in the stock market has a lot of risks, but you also have a lot of potential to grow your wealth. With M1 Finance App, you can create a well-rounded portfolio that will help manage the risks associated with investing. You can also track your investments in real-time and adjust as needed.

The app is designed to be easy to use, even for people just learning about finance and investment strategies. It provides information on the markets and various ways to invest quickly, so you don’t have to spend hours looking for it.

Invest by putting the Pie in your pocket– Manage your portfolio using Pies, our simple interactive dashboard. Pick your ETFs and stocks and create your investment plan easily. You can start with ready-baked Expert Pies adapted to various objectives or investment types.

Build a Unique Pie- Put your securities in Slices of your Pie. Or make a pie and make it an individual slice of your Pie overall to manage your portfolio.

Expert Pie- They compiled over 60 carefully selected Pies to suit various investment styles or objectives from responsible investing, dividend-paying companies, cannabis businesses, and more.

User experience

M1 Finance App provides a user-friendly experience for those looking to invest their money. The app has a sleek design and is very easy to navigate. You will be able to find the information you need without having to sift through too much content.

If an investment opportunity is available, it gives you instant access on the app/portal, so you won’t have to spend hours waiting around for an email alert or call from a broker.

If you’re looking for a simple way to invest your money, this app is perfect for giving you that edge over other investors.

Desktop Experience

The site is clean and straightforward with simple instructions for signing up, transparent performance metrics, and easy to navigate. It has tabs that provide information on your portfolio’s activity, including holdings and portfolio activity, as well as buttons to purchase or sell and graphs that break down the amount you’ve invested in details. Many Robo Advisors focus on enhancing the user experience compared to traditional financial sites, which is why M1 Finance certainly delivers here.

Mobile Experience

Like the Desktop version Similar to the desktop version, the M1 Finance app is rated highly user-friendly. The app’s user interface is similar to the experience on the website. It’s possible to perform almost anything using the app the same way you do on the web; It’s only an issue you prefer.

Customer Service Options

- Telephone and Instant Help Chat Bot

- Email Support, 24 hours turnaround time

- Robust help center articles

- There is no access to financial advisors

Education is key

Without education, you won’t make the most of the app. It’s not enough to download and try it out. You need to invest some time in learning about finance. It is because M1 Finance App will only teach you a small part of what you need to know about investing. Knowledge of finance will help you make educated decisions regarding your investments, ultimately leading to wealth building.

Commission and Fees

M1 Finance doesn’t charge any charges for portfolio management or trading. It is an exclusive platform feature that allows you to use more money. Instead, M1 makes money through loans, interest plus membership, and payment for orders flow. ETFs bought through M1’s platform are subject to fees direct to fund managers and not to M1 in the standard business practice.

M1 Plus members have to pay a $125 annual subscription fee. There’s also a miscellaneous fees schedule for any additional account management.

Summing Up

With the M1 Finance app, learn how to invest using your mobile device and find investment opportunities based on news and trends worldwide. Invest in stocks, bonds, currencies, and commodities and achieve your financial goals, like retirement, home buying, etc. Don’t forget to read all the documents and information carefully before approving/signing them up. Here are some more apps to help you invest in stocks and ETFs.