Geekflare is supported by our audience. We may earn affiliate commissions from buying links on this site.

Your credit score is what banks and credit card companies use to decide your worthiness for a loan or line of credit.

Being truly successful and financially independent means that you understand your entire financial picture, including knowing your net worth, having a retirement account, and having a good credit score.

Think of a credit score as a test score when you are in school. Your teacher uses it to figure out how well you understand the subject and if you are worthy of a high-performance report.

In the same way, a lender or a credit card company will use the score to determine if you are eligible to get credit extended to you. A high credit score helps a lender know that you manage your credit well, and you can pay back whatever money they loan to you.

What is a credit score?

Your credit score is a 3-digit number, usually from 300 – 850, that lenders and credit reporting companies use to assess you and quickly determine your worthiness in repaying debts. A good credit score determines whether you can get a loan, a credit card, rent an apartment, buy a car, and in some cases, qualify for a job. However, it is sad to note that 54% of adults do not check their credit scores.

You may have several credit scores from different companies as each generates its own report using different methods. You need to know what the credit score says and what goes into them so you will be in a better shape to use it. This leads to credit score monitoring.

Why should you monitor your credit score?

Credit score monitoring simply means monitoring your credit score to see any changes. It won’t cause your score to drop. The monitoring tracks your credit score to check for any changes or suspicious activities. There are many reasons why you need to monitor your credit score.

Terms of loan

Monitoring your credit score helps you know when you have a good score which will help you determine the rate, terms, and who will be willing to lend you money in the future. It also allows you to access lower rates, which helps you pay off your loan faster and pay less interest over time.

Important life decisions

Credit score monitoring affects many life decisions you will take, such as buying a car, getting a house, getting a job, getting a personal loan, auto loan, or even applying to rent an apartment.

Stop identity theft

Monitoring your credit score can help catch mistakes early and spot early signs of identity theft. If you don’t pay close attention, your personal information may be stolen and used for identity fraud. The early notice will protect your identity and stop potential fraud.

Plan your finances better

Proper monitoring of your credit score helps you understand how your financial activities impact your credit score. You’ll be able to identify areas you are making financial mistakes and then put in corrective measures to lead to a better financial state.

Customize notification

Many credit monitoring companies will give you a comprehensive service that allows you to customize your alerts, reports, and notifications. You can decide to set up an alert to let you know if there is a suspicious transaction on your credit card or set up alerts for the best loan rates depending on your financial requirements.

Credit score monitoring does not have any adverse effect on your credit as it is a soft inquiry. Banks, lending institutions, and credit card companies use three different credit bureaus to determine your creditworthiness.

The top 3 bureaus are Equifax, Experian, and Transunion, and they all differ in how they track your account. For example, Equifax separates your credit accounts into open or closed categories. So if your credit card account has been closed for five years, it will weigh differently from that which is still open. Equifax uses an 81-month credit history, unlike other agencies which use the traditional seven years.

How do you monitor your credit score?

It is not easy for you as an individual to constantly and adequately monitor your credit score. That is why it is good to engage the services of credit score monitoring service companies. These companies also scan the dark web to see if your information is being used there and keep track of your public records.

However, there are certain things that credit score monitoring would not do for you. It will not keep your information safe from data breaches, stop someone from opening new accounts and applying for credit in your name, prevent your credit card from being skimmed or report fraud. So there are limitations to what a credit score monitoring service can do for you. Still, when you consider the many benefits, it is good to have them.

Why does your score go down?

One of the benefits of monitoring your credit score is to know when your score goes down. You might become confused when you notice that your score has reduced even though there isn’t much change in your financial habits. There are many reasons this may occur. Here are some of them.

- When you apply for many credit cards at once

- When a credit provider reports new information to a credit agency

- If your account is sent to collections

- You made a big purchase

- You closed a credit card or loan account

- Your lender lowers your credit limit

- Your credit report from any agency has a mistake on it

This is why you need to consciously and regularly monitor your credit score to know when any of this has occurred and takes steps to remedy the situation.

It is not an easy task for you to monitor your credit score. However, credit score monitoring is easy with the following solutions below. These services were chosen after considering the service cost, the credit scoring model used, dark web scanning, identity theft insurance, and the number of bureaus monitored.

Equifax Credit Monitor

With Equifax Credit Monitor, you can monitor your credit score and lock your credit report with alerts. You will get a VantageScore credit score and see the trends over time with daily access. You will also know when key changes occur to your credit score with custom alerts.

You can easily lock your report and be alerted if someone tries to access it. This lock feature gives you a secure sense of awareness when you know that your account can only be accessed when you want and for what you authorize. This gives you absolute control over your credit score.

Credit bureaus monitored: One with the Equifax credit monitor, while all three are monitored with the complete and complete premier plans.

Dark web scanning: Yes, for Equifax’s complete premier plan.

Identity theft insurance: Yes, up to $1m

Transunion Credit Monitoring

This is one of the three major credit bureaus and it has an excellent reputation for providing reliable credit score monitoring services. They help you know where you stand in terms of credit score, what you have built so far, and see the way forward.

With TransUnion, you get unlimited scores and reports access with daily updates. You also get counsel on credit cards, personal loans, key topics and discover the latest trends in identity protection. Transunion credit monitoring gives you the latest updates whenever there are changes on your Experian credit report.

Credit bureaus monitored: All three bureaus.

Identity theft insurance: You get free identity protection called TrueIdentity. You have insurance up to $25k, all 100% free.

Dark web scan: Yes

Ovation Credit Monitoring

Ovation prides itself in helping you check your credit score to ensure that there’s no error that might lead to a low score. They work in conjunction with Transunion and can also help with disputes, especially regarding inaccuracy in your credit report.

They offer you real-time alerts, so you are always aware when changes are made to your report. You also have the clarity that comes with their identity theft security since you get notifications if anything changes which allow you to respond fast.

Credit bureaus monitored: All three bureaus.

Identity theft insurance: N/A

Dark web scan: N/A

CreditSesame Credit Score Monitoring

This is an entirely free credit score monitoring service that partners with the Transunion credit bureau. With CreditSesame, you will receive monthly credit score updates and credit monitoring alerts just for you to stay on top of your credit score and keep up your financial health.

They offer real-time alerts, so you’ll know immediately when an important change has been made on your Transunion credit report. They provide a snapshot of your interest rates, debt, loan payments, and credit use in one convenient dashboard.

The advanced and platinum plans give you daily score updates and updates from the 3 bureaus. The platinum gives you 247 live experts that are available to help you recover your wallet if lost or stolen.

Credit bureaus monitored: One with the basic plan, while all three are monitored with the advanced and platinum plans.

Identity theft insurance: Yes, up to $50k

Dark web scan: Yes, with the platinum plan

Moneysupermarket Credit Monitor

This is another credit score monitoring service company in the UK that offers free credit score updates in conjunction with Transunion. Moneysupermarket uses a product called credit monitor to give you monthly credit score updates.

All you need to do is to provide your most recent address to show your residency to make use of the service. They show you which credit card you would be eligible for and offer tips on improving your credit score.

Credit bureaus monitored: One bureau, TransUnion.

Identity theft insurance: None

Dark web scan: No

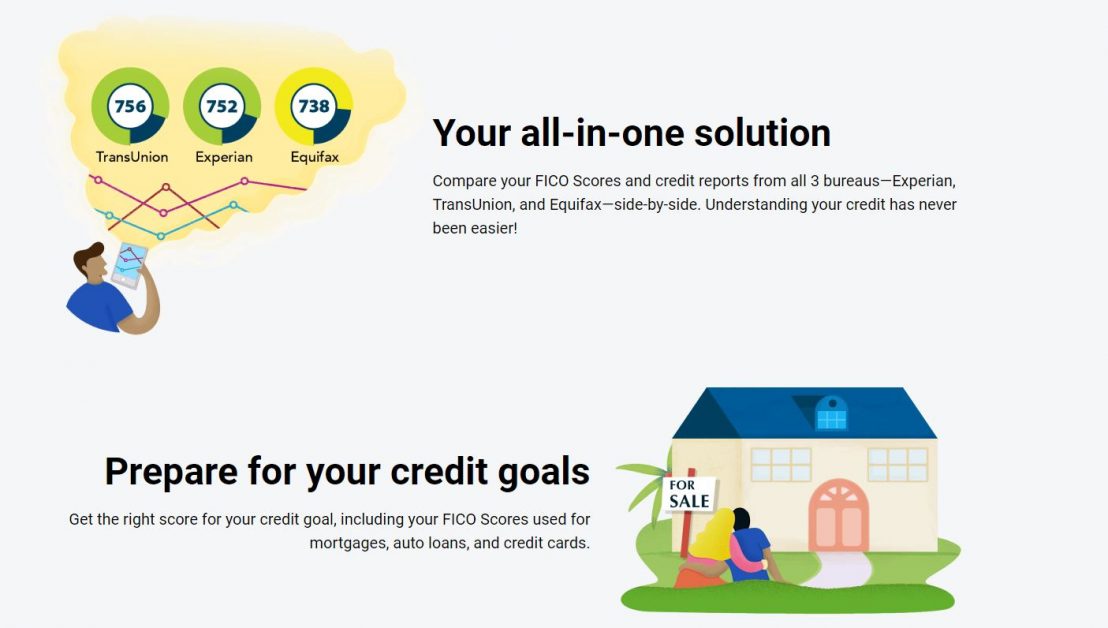

myFICO Credit Score Monitoring

myFICO is another monitoring service that uses FICO Scores. FICO is an acronym for Fair Isaac Corporation, and it is a mathematical formula used to calculate credit. FICO scores are used in over 90% of lending decisions making, making them the most accurate for credit score updates.

Credit bureaus monitored: The basic plan monitors your credit at Experian and tracks new account openings and inquiries. The advanced plan monitors reports from all three bureaus and everything included in basic. The premium includes everything in both basic and advanced and also includes changes to your name on your credit report, new employment, and fraud alert. All three offer access to 28 versions of your FICO score. This score includes mortgage, credit cards, and auto loans.

Identity theft insurance: Yes, up to $1m. Plus you have 24/7 access to US-based identity theft experts who can help to restore your identity if your information is found to have been compromised.

Dark web scan: Yes, for advanced and premier plans

Final thoughts 💳

A good credit score opens you up to a range of financial benefits. Using a good credit score monitoring service will help you be on top of your game. You need credit monitoring services as it is their job to keep an eye on your credit score. Pick from any of the ones listed here and avoid falling into a scam monitoring company that can put your identity in jeopardy.