As digital technologies advance and become more widespread, fraud is evolving, getting more sophisticated, and hard to detect.

Over the past few years, the number of internal and external fraud cases targeting private, public, government, and other organizations has been on an upward trend. While the banking and healthcare sectors account for the most online frauds, other industries such as e-commerce and others are also vulnerable.

As the attack surface expands, cybercriminals are increasingly using new and sophisticated techniques to exploit security gaps in applications, networks, authentication, and other areas.

Generally, any fraud exposes the business and customers badly and results in loss of money, products, reputation, sensitive data, etc. Also, customers may lose trust in the compromised business and look for alternative providers – and this means reduced revenues and potential losses.

Preventing fraud reduces losses while maintaining a company’s credibility and protecting the business and customers’ private data. Ideally, a solution that detects fraud in real-time will reduce fraudulent transactions, losses, recovery time, and costs. It also improves operational efficiency and customer retention.

Online fraud prevention strategies

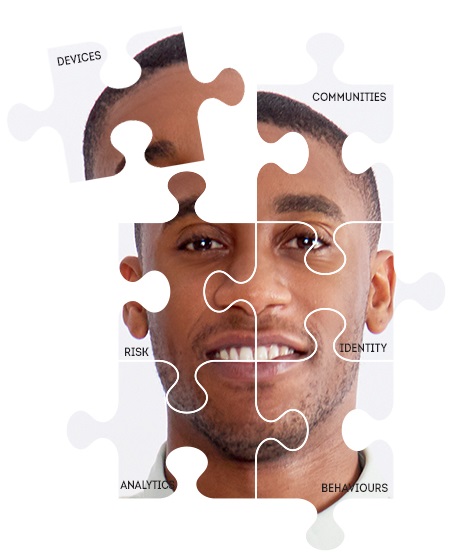

Fraud detection solutions enable organizations to detect high-risk, fake, or illegitimate online transactions. Good tools should have the ability to continuously monitor all the transactions, user behavior, devices, and other metrics. They then analyze and calculate the risk scores to determine or detect potentially fraudulent transactions such as illegal purchases or access, ad click spam, bots, stolen cards, etc.

Although it is impossible to prevent 100% fraud, using a multi-layered approach combining best security practices and tools, strong authentication, and other solutions can reduce the majority of illegal transactions and activities.

Unfortunately, there is no single solution for protecting your business from all types of fraud. As such, you need a multi-layered approach and a variety of security and fraud prevention tools relevant to your operations. These should provide overlapping coverage against all potential fraud that could be targeting your business and customers. Organizations need to deploy a varied mix of solutions with overlapping coverage to detect and prevent different types of fraud.

Ideally, a good fraud detection and prevention tool should have capabilities such as;

- Proactive monitoring of all transactions to identify high-risk behaviors, traffic, and potentially fraudulent activities

- Ability to calculate risk scores of a transaction hence its legitimacy.

- Automatically detect and block fraudulent activities

- Support compliance with standards and privacy regulations

- Alert teams about risky transactions

Fortunately, there are solutions available to protect your business from online fraud. Let’s explore them… 👀

SEON

SEON is a powerful and fast AI-powered fraud detection and prevention platform with custom rules and an intuitive control panel. The tool enables organizations to establish their customers’ digital footprints – allowing them to detect and remove illegitimate accounts, stop fraudulent transactions and other attacks.

Consequently, it reduces the loss of money, time, and other resources resulting from fraud. In particular, the tool offers the ability to automate the decision-making process and response, perform KYC checks and improve compliance.

Key Features

- Real-time data engine provides up-to-date data and zero false positives.

- Easy to integrate with your existing systems via an API

- Automatically identify and block fake accounts and fraudulent transactions.

- User-friendly, modular solution with flexible pay-as-you-go plans. No upfront or hidden costs, no long-term contracts, or vendor lock-in risks.

- Provides complete visibility into a customer’s behavior, reduces fraud, chargebacks as well as bonus abuse.

- Filtering and blacklisting of illegitimate and risky accounts and devices.

Fraud.net

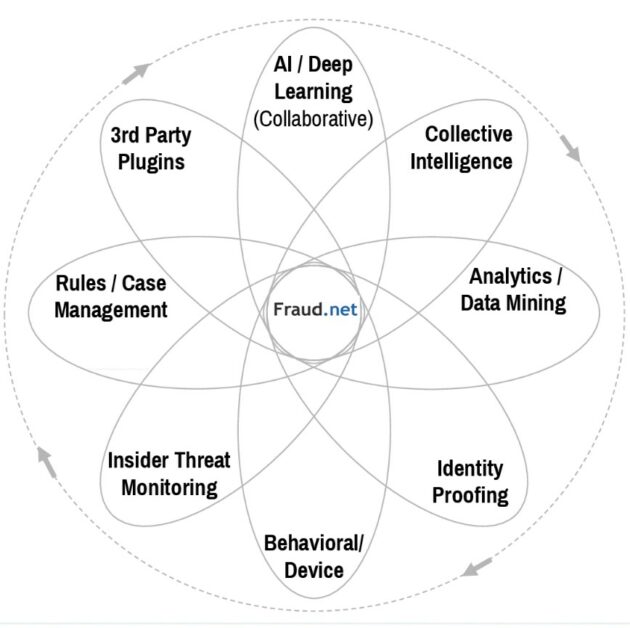

Fraud.net is a comprehensive suite of security products that enable financial, e-commerce, travel, and other industries to detect and prevent a wide range of frauds. The scalable SaaS platform combines AI, deep learning, live stream analytics, risk intelligence, and rules-based decision engines to detect and block fraud with high accuracy in real-time.

Key features

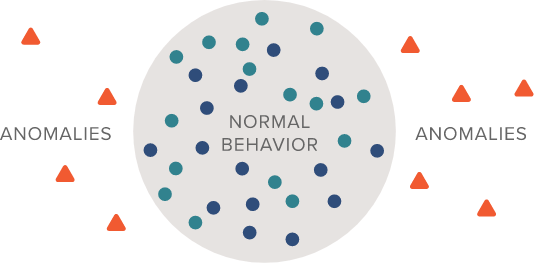

- It uses big data, artificial intelligence, and real-time data visualization to gain insights into the activities and quickly detect and pinpoint and stop anomalies and fraudulent transactions.

- Detecting fraudulent financial transactions through verifying customer accounts, internal fraud monitoring, custom rules and suitable for banking, e-commerce, insurance sectors, and other industries

- Detect and prevent mobile fraud by gaining by developing device profiles and gaining insights during the customer journey.

- Uses a combination of real-time intelligence, controls, and anomaly detection to identify and prevent marketing and affiliate fraud. Businesses, therefore, won’t pay for false and undeserved commissions to affiliates. It also stops people from paying for products using stolen identities and cards.

- Automated multi-factor authentication to weed out bots and suspicious users

Xceed

Nice Actimize Xceed is a cloud-based comprehensive solution that protects businesses from online financial fraud and crime while enabling compliance with relevant policies and regulations. The tool has advanced self-learning abilities to adapt to evolving attack modes and changes in customer behaviors.

Generally, the Xceed is suitable for regional banks, credit banks, and similar organizations where it offers advanced financial crime risk management powered by data intelligence, AI, and behavioral analytics.

Key Features

- High fraud detection accuracy

- Provides real-time behavior analytics

- Real-time Know-Your-Customer (KYC) and Customer Due Diligence (CDD) analysis,

- Comprehensive AI-powered fraud and Anti-money Laundering (AML) protection

- Real-time behavioral analytics powered by machine learning technologies.

Kount

Kount is powerful, AI-driven fraud protection and identity trust solution that prevents e-commerce fraud, account takeover, and bot attacks while enabling you to reduce chargebacks. The effective fraud prevention tool protects the complete customer journey while helping g you to manage disputes.

Key Features

- Analyze and determine the level of trust of identity behind a login, account creation, and payment process.

- Uses supervised and unsupervised machine learning to analyze billions of trust and fraud-related signals upon which it delivers data-driven decisions instantly.

- Create custom risk thresholds based on potential fraud rates, costs, and operations

- Artificial intelligence to identify and prevent emerging and existing fraud.

- Uses supervised machine learning to learn from past cases and unsupervised to detect emerging frauds.

Adjust

Adjust fraud prevention suite is a comprehensive solution that proactively blocks a wide range of fraud before they happen. In particular, it can detect and prevent ad fraud in real-time. The tool enables you to monitor, detect and stop ad fraud, such as what results in manipulated datasets and stolen ad budgets.

Key Features

- Ensure that your data sets are clean and reliable

- Multi-layered encryption that allows businesses to detect and block fraudsters

- Uses an automated and dynamic filter to allow only the genuine installs while rejecting click spam and fraud

- Identifies and blocks bot traffic, click injection, fake clicks, spam, SDK spoofing, and more.

- Automated detection and highlighting abnormal Click To Install Time (CTIT) rates.

IDVision

TransUnion’s IDVision with iovation is an effective fraud and identity security suite that helps to detect and block a wide variety of online threats. The comprehensive solution combines machine learning and traditional data tools to provide detailed insights into all transactions.

It can automatically predict the risk level of each transaction and provide the necessary protection. For example, it protects businesses against credit card fraud, account takeover, application fraud, and other online crimes.

Key features

- Easy to configure flexible multi-factor authentications provide and an extra layer of security for users.

- Uses device-based authentication to protect users and businesses from online fraud and other security risks

- Ability to analyze user or device behavior and prevent fraud by identifying and blocking suspicious transactions, accounts, and activities

- Verify user identity based on a broad set of digital and personal data

- Uses Truvalidate device information, analytics, and risk insights to identify and stop suspicious and fraudulent activities in real-time.

- Secure each touchpoint with custom risk-based authentication or solution depending on the risk level

RSA

RSA Adaptive Authentication is a comprehensive solution that uses advanced risk scoring and machine learning technologies to analyze various risk indicators and detect fraud with accuracy. The powerful fraud detection solution, suitable for either on-premise or cloud deployment, is highly flexible with a broad range of deployment and configuration options.

Further, it employs risk-based authentication techniques to protect the users accessing online portals, websites, apps, IVR systems, ATMs, etc.

Key features

- Cost-effective and easy distribution and allocation of real-time authentication tokens

- Allows you to protect online transactions, accounts, and information.

- Provide risk-based authentication based on potential risks at, and post user login

- Self-learning risk engine that protects systems against emerging and existing fraud threats

- device and behavior profiling to analyze the devices and users activities

- Tracking flagged user or device activity using the case management tool

AppsFlyer

AppsFlyer Protect360 is an excellent protection suite that protects businesses from ad fraud. The tool uses machine learning algorithms to analyze the traffic over the entire customer journey during and after an install, hence detect and prevent unusual app events from suspicious sources.

Key features

- A layered approach that provides real-time fraud detection and prevention

- Ensures that you only pay for the actual, user-driven, and verified installs.

- Uses behavioral biometrics to identify and block bots and botnets in real-time. The scalable tool can identify bots, including widely distributed and highly targeted.

- Automatically detect non-human behavior patterns, and stop fraudulent traffic in real-time.

- Detect and block installs high jacking, click flooding, bots, device farms, and others in real-time.

Conclusion

Today, any organization with an online presence or form of a network is vulnerable to external or internal fraud attempts. As such, it is vital to deploy an effective strategy to stop the crime.

Organizations can deploy a mix of relevant tools and best practices to detect and prevent fraud originating from internal and external users or devices. Using the tools enables the teams to check the vulnerable areas, ensure that only legitimate transactions pass through, and block all fraudulent activities. Consequently, the companies can protect their businesses, customers, and all sensitive data.