Manage your employee payroll like a cup of cake 🧁 with the following solutions.

Payroll management systems are in demand these days. And more and more businesses want to streamline and automate many areas of their business, especially stressful and repetitive ones.

That said, the payroll process is time-consuming and can be expensive. Besides, it may also involve human errors resulting in a huge business catastrophe due to payment inaccuracies, late tax submissions, and failure to comply with payroll tax laws.

According to a SurePayroll survey, 45% of the total respondents admitted they are familiar with certain regulations that do not exist in the first place! It also showed that 24% of them spend 4 hours every week managing payroll in a month.

Thankfully, cloud-based payroll software is there to take that burden away from you so you can spend time on important things like hiring candidates, monitoring performance, maintaining a good company environment, and many more, instead of running after repetitive tasks.

So, let’s understand things about payroll software and how it can help your business.

What is payroll software?

Payroll software is designed to automate payroll processes such as managing salaries, wages, deductions, bonuses, and taxes. It is also capable of tracking time off, employee benefits, vacation accrual, and much more.

It helps in many ways, including the following.

Saves time ⏱️

As you don’t have to spend your time working on repetitive tasks such as generating slips and distributing them, bookkeeping, maintaining employee details manually, etc., you can save a lot of your time.

No need for outsourcing

With the intuitive software in hand, you don’t have to outsource payroll services. It helps you save your money and eliminates the probability of confidential data leaks to a third-party. Hence, your financial data stays safe and confidential within the premises of your organization.

Better transparency

Your employees can help themselves, fill-in, their details, and access accurate payroll information such as salary, deductions, and taxes. This way, it increases transparency with your employees and fosters mutual trust.

Improved accuracies

As the software handles critical processes like tax calculations and filing, insights and report generation, and so on, you run no risk of inaccuracies. All the data it provides will be accurate and useful in real-time.

Ensures compliance ✔️

Tax regulations and rules change frequently. Any deviation from compliance or missing a deadline may cost your business heavy penalties.

For this, payroll software maintains current federal, state, and local laws updated. And it also notifies you of compliance requirements and tax deadlines, ensuring you stay compliant always.

Its showtime. Let’s explore the following online payroll software.

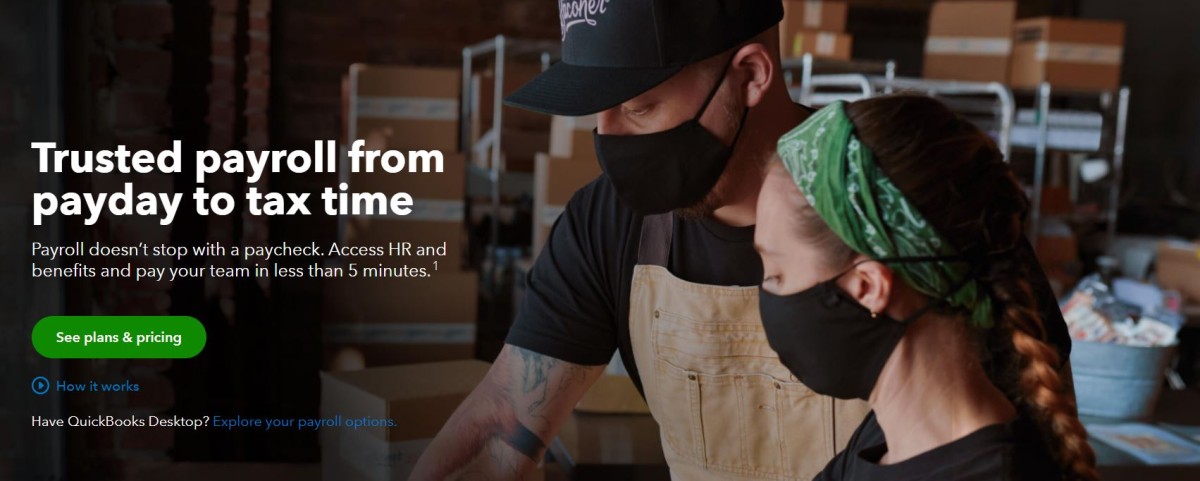

QuickBooks Payroll

QuickBooks is one of the most trusted payroll systems that can handle the hassles of your payday and taxes. You can schedule and run payroll automatically, so you don’t have to do it at the last minute and commit mistakes.

Let them handle the heavy tax calculations and then file and pay the payroll taxes on your behalf. If you want, you can always proceed with direct deposit on the same day. You can also manage employee benefits and HR using the same account. Manage everything in a single place and approve payroll only when everything is ready, and gain integrated employee solutions.

With QuickBooks, you are covered with tax penalty protection, where they will pay you up to $25,000 in case there’s an error in the tax submission process, and you get a payroll tax penalty. Leverage time tracking to approve timesheets, create invoices, and pay the team members on the go.

More features include HR support to set up the account, tax-time coverage, quick answers to your problems, workers’ compensation on account of on-the-job injuries, health benefits with affordable insurance packages, and 401(k) retirement plans.

They offer you all these amazing features even if you have a small budget. The plans start at $12.50/month.

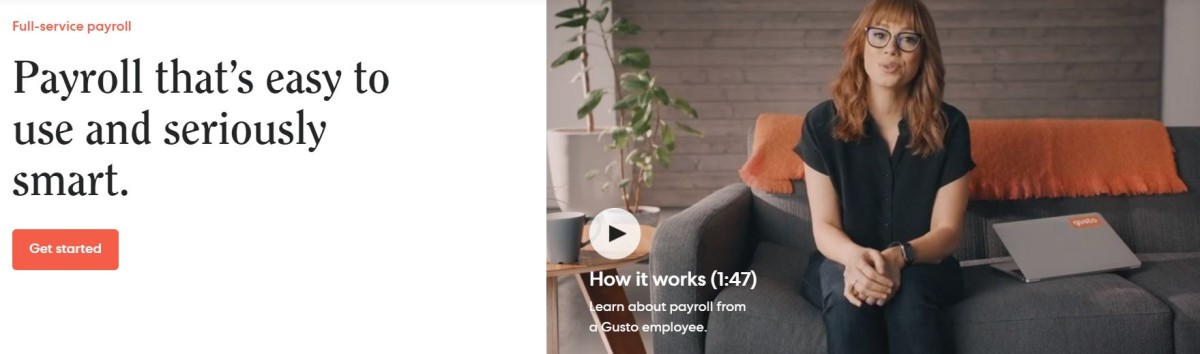

Gusto

The smart and easy-to-use payroll system of Gusto can be your next payroll software no matter what your business size is. Process payments manually or schedule them through Autopilot mode in a few clicks.

They calculate all the federal, state, and local payroll taxes accurately through e-sign, e-tax, and e-file technologies and pay them automatically. Gusto also helps in reporting new employees to the government, so you stay compliant with the laws. They also offer child-support garnishments and can adjust wages automatically to stay compliant with FLSA Tip credits.

Gusto offers flexible features such as Gusto debit card to access money easily and net-to-gross calculations (which makes it easy for bonuses). Go paperless with direct deposits, customize pay schedules according to your team members’ needs, and run unlimited payrolls. You can also add pre-tax deductions for benefits or go for post-tax for garnishments.

Use the software to support both salaried and hourly employees, pay your contractors through Gusto, and let it file and automatically send the taxes. Perform easy cancellations, reimbursements, and process flexible payment frequencies monthly, bi-monthly, or bi-weekly.

Gusto offers advanced payroll features such as payroll reports, including payroll history, contractor payments, bank transactions, tax payments, and more, and allows you to download them. Integrate Gusto with time-tracking software like Xero and FreshBooks, accounting software, and sync expenses automatically.

Perform effortless employee management with direct deposits, conduct charitable donations where deductions will be made directly, and organize your employees and contractors well. Let employees access their paystubs easily in their Gusto account, payday emails, or Gusto’s Wallet app.

You can also add digital signatures, including your bookkeeper, accountant, and other team members. Run payroll anywhere using their user-friendly app, and you can also sync birthdays, payroll deadlines, and anniversaries in Outlook, Google Calendar, or iCal.

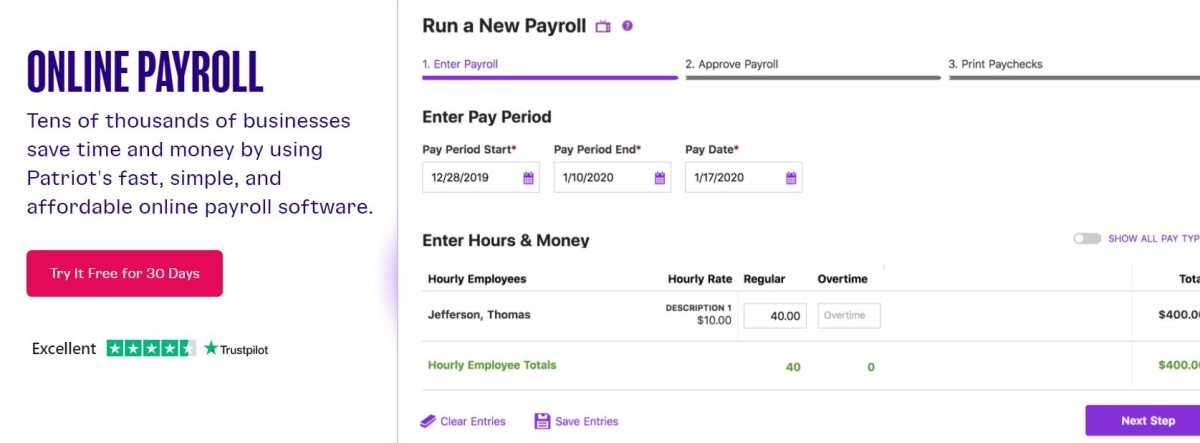

Patriot

Use the simple, affordable, and fast online payroll system of Patriot and increase your efficiency. They offer two services, full and basic service.

In Basic payroll, getting started is easy, along with setting up the payroll, tax information, and employees. They will also help you with historical data for your previous payrolls. Next, running your payroll online is simple in 3 steps:

- Enter the work hours of your employees along with contractor payments

- Approve the payroll with fast and accurate calculations

- Go paperless and save trees using a free direct deposit or print paychecks/ pay stubs.

Lastly, they also provide you with important data needed to deposit or file your payroll taxes. But, if you want to save yourself from the hassles of managing payroll taxes, upgrade your plan to the Full-Service Payroll.

Using the Full-Service Plan, payroll taxes get easier with their timely and accurate tax filings for federal, state, and local taxes. Apart from tax filing, they also handle deposits and decide which taxes are crucial, based on your organization and business type.

With Patriot, you can avail different payroll reports:

- Payroll detailed report showcasing employees, checks, totals, and locations. You can download it as a CSV or PDF file.

- Tax filing reports will automatically be stored in the software. Just choose the payroll tax year to view the filings for each quarter.

- Tax deposit reports with details like filing dates, payroll period, and amount. Choose a year and view both scheduled and processed tax payments.

- Contribution history of your employees.

Its Basic Payroll is priced at $10/month, while Full-Service Payroll is priced at $30/month. Both include a 30-day free trial.

Paychex

Improve your payroll accuracy and save time by choosing Paychex that makes it a lot easier to input employee hours, maintain employee wage & hour laws, and calculate taxes.

View your present and future pay periods quickly and complete the next payroll hassle-free from the Payroll Center. Run payroll by entering details in just a few clicks, choose from 3 pay-entry options such as grid view, and customize payslips, deductions, and earnings.

You can also customize reports based on your chosen package to fit your requirements at no extra cost. Use the feature People View for adding new employees, who can also be invited to complete their details such as personal data, tax withholding, etc.

Paychex offers multiple payroll services such as:

- Small Business Payroll service handles tax and payroll processing by outsourcing these time-consuming activities and helps you concentrate on your growth.

- And easy online payroll and HR solution.

- Midsize Payroll solution that helps larger companies handle employee paychecks, HR tasks, and compliance

They also help you compare different solutions and choose a plan based on your business requirements. Paychex makes it effortless to switch with just a few pieces of information if you already use another payroll system.

Paychex helps you calculate, file, and pay your payroll taxes, helping you enable tax credits. They make the onboarding process easy with one-to-one customer service through US-based support via calls, live chat, and in-app support such as guides and articles.

Paychex offers multiple employee payment options such as pay-cards, direct deposit, pay-on-demand, and paper checks. Use the mobile app to handle payroll tasks from anywhere and choose from multiple pay-entry options.

Their online payroll solutions are accurate with a built-in safeguard, including notifications in major payroll issues like data mismatch. Let your employees access their payroll information and save time answering common questions or let them talk to the administrator via the Flex chat.

PrimePay

PrimePay is an efficient solution to all your payroll, tax, and HR activities so you can manage your team well and focus on growing your business more.

Their Starter bundle includes key functionalities that address your payroll needs, HR, tax, and reporting requirements. PrimePay’s payroll solution helps you improve your business efficiency with easy payroll processing and handling local, state, and federal taxes on time.

This online payroll processing system has strong security with 2-factor authentication, options like direct deposit and pay cards (electronically or printing checks), and payroll delivery options. Employees can access pay statements, view, save, download their data, and get automated emails to view pay stubs.

Free client data recovery and backup, in addition to monitoring and detection of payroll service, are available to mitigate malware, hackers, and viruses. Conduct a smooth employee onboarding with this tool with state and federal documentation, employee handbook, tax documentation, direct deposit info, customized forms, and more.

You can also track applicants and file WOTC tax credits. PrimePay offers HR compliance and support with features such as automation services for employee verification, HR insights, limited employment and HR advice from attorneys, accessing employment law updates, checklists, and templates.

PrimePay offers reporting features such as unlimited online reports for payroll & timesheet journals, year-to-date master, tax, monthly summaries, deductions, labor distribution, workers’ compensation, etc. You can also access Report Center for custom reporting services, export capabilities, tax reports, online pay statements, and more.

Try their Starter bundle plus WFM or Workforce Management to manage time and attendance. Features included in this are employer and employee mobile access to time-off requests, PTO balances, and timesheets; balance tracking, manager approvals, geofencing, FMLA/FLSA reporting and tracking, and more.

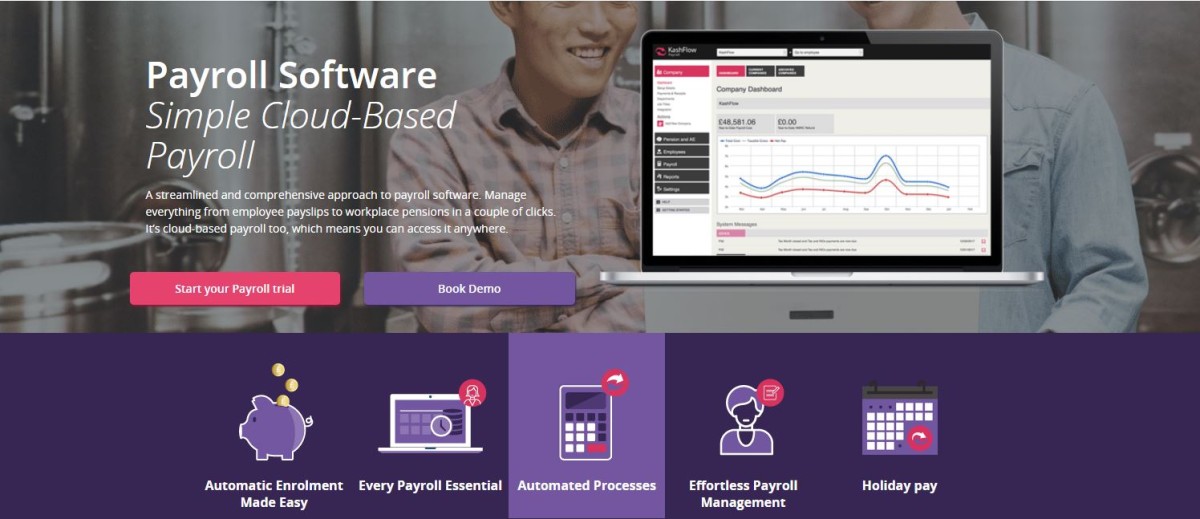

KashFlow

The easy-to-use cloud-based payroll software of KashFlow offers a comprehensive and streamlined approach to the entire payroll management. It can handle everything from workplace pensions to employee payslips in a matter of clicks, no matter where you are.

KashFlow helps you assess employees automatically and enroll them based on a qualifying plan. You can calculate contributions and create accurate documentation for both employees as well as pension providers.

Whether you are a small business or large, they offer effective payroll management for monthly salaries, holiday pays, and hourly wages while updating employee tax forms and insurance information precisely. Use the automated payroll to process data in one go towards the end of a month or week. It does not need additional user input, and therefore, saves you time.

The software has information pointers to view concepts and terms such as the Tax Calculation Method to help everyone understand things better. It includes employee self-service, enabling employees to access their payslips and data at any time. KashFlow integrates with Bookkeeping features so you can add payment details and view your business finances quickly.

You can edit payslips and let the software update the changes seamlessly. It can also submit your RTI documents automatically.

TRAXPayroll

TRAXPayroll by BambooHR accelerates and simplifies the way you manage payroll. It offers world-class integration in addition to automatic data synchronization for easier and fast payroll.

It is an exceptional tool for US-based employees with a simple payroll process, state and federal tax filing, and customer support. TRAXPayroll helps you pay your employees confidently, so you can uphold your sanity with accurate calculations and save valuable time.

With TRAXPayroll’s seamless integration with BambooHR, data like hours, wages, account numbers, deductions, benefits, and withholdings sync automatically. As a result, you can avoid double data entries and maintain your data updated.

Allow your employees to access their data in BambooHR and offer single-sign-on for your admins to access TRAXPayroll and BambooHR both. You can access 100 standard and exportable payroll reports instantly. It helps you assess cash requirements, total deductions and analyze payroll summaries of employees.

TRAXPayroll protects your sensitive employee and payroll data with security features such as a 3-tier backup redundancy plan, continuous monitoring, sophisticated data encryption, and multiple data center locations.

PayFit

Leverage the automated and fully integrated payroll and HR system of PayFit and manage everything hassle-free. It automates everything right from payslips and RT submissions to employee expenses and leaves to help you concentrate on important things.

Make changes quickly in real-time, run payroll in simple clicks, and save your time. PayFit facilitates automatic payslip generation and distribution, allows editing of pay variables, updating and viewing payslips, and ensures HMRC compliance.

PayFit handles HMRC RTI & pension submissions, provides periodic notifications, submission summaries, and more. Apply wide-ranging employee benefits and deductions accurately to make sure all the tax calculations are done right.

Access your company data quickly along with important information with more autonomy and effective reporting. PayFit is compatible with QuickBooks, Sage, Netsuite, and Xero. You can also verify reports and eliminate errors and export them for HR and finance teams.

Xero

Experience smooth accounting and payroll management in a single platform of Xero. Pay your employees without errors and secure your basic records within the software.

Run payroll seamlessly, auto-create a batch payment file for individual pay run, and generate slips electronically or take the printout from Xero. You can set the payment period, frequency, and date. And let them synchronize all your payroll information with Xero after every pay.

As Xero automatically creates payment files for pay runs, making payment becomes easy into an employee’s bank account. You can choose the employees to exclude/include in a pay run, manage records with their bank details, and upload the payment files in batches to your online banking system.

You can choose to print or email payslips at once or individually for employees, showing total pay, earnings, and deductions. Besides, you can also add a quick note to payslips if you need to. Run reports and review pay runs in a single click to get insights and the breakdown of all the amounts paid to each employee during a chosen pay period.

Manage employee details efficiently by adding data such as wage rate, tax number, bank details, email, postal address, and more, and rest assured all the data is safe with multi-layered security. Its plans start from $20/month.

Wave Payroll

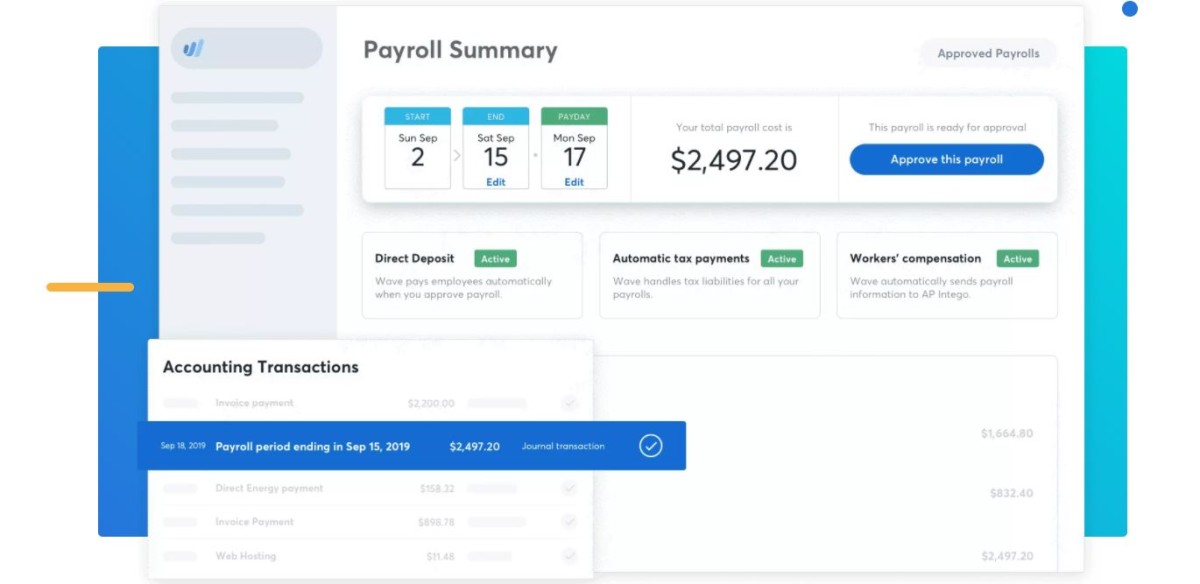

Wave Payroll is an excellent cloud-based software to manage payroll, especially for small businesses. It integrates completely with Wave Accounting along with other applications to record payroll-related expenses automatically.

Wave Payroll is easy to set up and comes with exciting features such as employee accessibility. They can view pay stubs in real-time and track working hours, vacation time, and overtime. Some of the features include invoicing, online payments, benefits management, a self-service portal, accounting, lending, receipts, the ability to print paychecks in-house, and more.

Their accounting module lets you create customized invoices, manage taxes, scan receipts, generate accounting reports, calculate payment transactions and exchange rates. They also offer a direct deposit option and help you pay the contractors easily through wave Accounting.

Users can also generate recurring bills, manage bookkeeping, set payment reminders, share invoice status, and make credit card payments. Currently, they offer this solution only in the US and Canada. However, only 14 states can utilize their full-service, while the other states can go for self-service.

Their full-service plan starts at $35/month, while the self-service plan costs $20/month.

Conclusion

Payroll management is crucial whether you are a small, medium, or large business. You need to make sure your employees and contractors get paid conveniently, accurately, and on time. For this, you can use any of the payroll management tools mentioned above and run payroll effortlessly while managing your taxes and staying compliant with the laws.

Next, explore some of the best cloud-based HR management solutions.