Accounting cycles help businesses monitor their financial activities by recording and analyzing financial transactions over a specific accounting period. It is a structured process that starts when a financial transaction occurs and ends when the books of an accounting period are closed.

Throughout this cycle, every transaction is systematically recorded and then subjected to changes for necessary adjustments before preparing financial statements. This systematic review ensures accurate, timely, and organized financial information for an organization.

The accounting cycle benefits all businesses, regardless of their size or industry, as it helps them work more efficiently and make informed financial decisions. We will discuss the accounting cycle, how it works, why it matters, some common challenges, and how you can manage it for your business.

What is an Accounting Cycle?

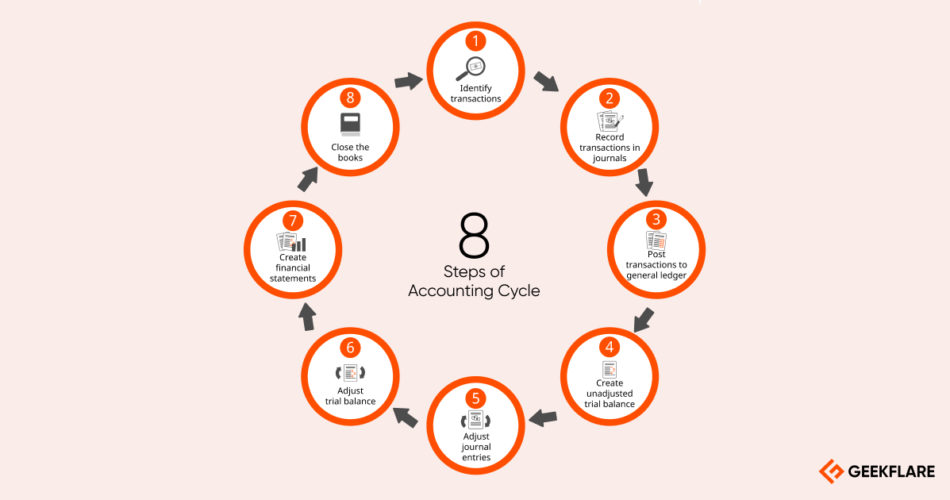

An accounting cycle is an 8-step process that systematically records, analyzes, and reports all a company’s financial transactions for a given accounting period. It starts with documenting all financial transactions and ends with posting closing entries to finalize the accounts for that period, which could be either monthly, quarterly, or yearly.

The Federal government follows a fiscal year from October 1 to September 30 of the next year. Each fiscal year needs a fresh cycle to maintain consistent financial reporting across all periods. This systematic nature of the accounting cycle and sound knowledge of the key accounting terms are necessary to maintain accurate and consistent financial records for investors, lenders, and other concerned stakeholders.

Importance of Accounting Cycle

Since an accounting cycle is a periodic process, every financial activity is meticulously classified for an overall view of the financial performance. At the end of each period, all respective income and expense accounts are closed and then reset, which prevents data from accumulating or reflecting wrong numbers.

This way, the accounting cycle ensures accurate financial records for tax filing, as unorganized accounting records or incorrect information might lead to legal troubles with the Internal Revenue Service (IRS) and misrepresentation to lenders, creditors, and investors.

8 Steps of an Accounting Cycle

An accounting cycle takes place in 8 phases that record and organize transactions for precise reporting. Below are the accounting cycle steps.

Step 1: Identifying and Analyzing Transactions

The first step involves correctly identifying financial transactions such as sales, purchases, debt payments, or any other events that occurred within the accounting period. Each transaction must be accurately identified, classified, and analyzed for its impact on the company’s financial position.

These transactions are usually gathered from source documents such as sales invoices, receipts, and purchase orders. They are evidence of transactions that help a business keep track of activities related to sold products, payments to employees, or money borrowed.

However, most modern businesses use point-of-sale (POS) systems directly linked to accounting software. This setup automates the recording of sales transactions and reduces the chances of human error. Beyond sales, other financial activities like expenses can differ widely, including rent, utilities, and wages. These details must be carefully identified and analyzed to ensure completeness and accuracy in the financial records.

Step 2: Recording in the Journal

Once transactions are identified, they are entered in the journal in chronological order. Each entry specifies the transaction date and accounts involved in the amount to be debited or credited.

According to the double-entry bookkeeping system, every transaction must have at least two entries – a debit and a credit. This represents the fundamental accounting equation that must remain balanced.

Assets = Liabilities Equity

This method supports accurate preparation of financial statements like the balance sheet income statement and cash flow statements – all of which need balance transactions on both sides.

However, the way transactions are recorded heavily depends on the accounting method a business prefers:

- Accrual accounting: Transactions are recorded when they occur, irrespective of when cash is received, while revenue and expenses are matched in the period they occur. So, when a sale is made on credit, revenue is recorded at the time of the sale, even though the cash will be received later.

- Cash accounting: Transactions are recorded only when cash is received or paid. This method is comparatively simple but can show different timings for a transaction in terms of financial results, especially for businesses with frequent delayed payments or credit sales.

Step 3: Posting to the General Ledger

In this step, data recorded in the journal is transferred to the relevant accounts in the general ledger. However, this process needs precision as debits and credits from the general must be accurately transferred to the corresponding accounts in the ledger.

If a journal entry debits one account and credits another, the same must be done in the general ledger to maintain consistency with the double-entry accounting principle. Every time a transaction is posted, the account balance is updated to reflect the updated financial position.

For example, posting a cash transaction would decrease the cash account balance, but posting a revenue transaction would increase the sales account balance. This must be reflected uniformly in the journal and ledger.

A business may choose how frequently it posts transactions. This can be done daily, weekly, or monthly, but it must be consistent for accurate financial tracking. Once all transactions for a period are posted to the ledger, the company can use this data to prepare the financial statements. Due to this reason, the ledger is often considered the central depository of all the company’s financial activities as it gives a clear idea of income, expenses, assets, and liabilities.

Step 4: Unadjusted Trial Balance

This step ensures all transactions recorded in the ledger are accurate before making any adjustments. Once all transactions from the journal are posted to the general ledger, the next task is to prepare this trial balance.

It lists all the accounts from the ledger and their balances. Accounts with debit balances, such as assets and expenses, are placed in one column, while accounts with credit balances, such as liabilities, equity, and revenues, are placed in another. This ensures that the total debits equal the total credit. Any mismatch in these two columns indicates an error in the recording or posting process, which must be corrected before proceeding.

Note: This version of the trial balance doesn’t yet reflect any adjustments for accrued revenues or expenses. Once adjustments are made, the adjusted trial balance will be prepared for final reporting.

Step 5: Worksheet

A worksheet is an optional tool in the accounting cycle that many businesses use to check the accuracy of financial records before finalizing anything. Even though it’s not mandatory, worksheets can be useful in spotting errors beforehand, especially when it comes to balancing debits and credits. If the numbers don’t match, these worksheets make it easier to spot what exactly went wrong.

Worksheets help businesses double-check their trial balances and adjustments by organizing data so errors in the unadjusted trial balance can be identified before moving on to the preparation of financial statements. This can give a helpful summary to businesses that have complex financial activities or need to make a lot of adjustments.

For instance, some businesses often reconcile inventory during this step, where they might conduct cycle counts (sample checks of their stock) and compare them with their records. If there is a mismatch, the balance can be adjusted before finalizing the numbers.

Step 6: Adjusting Entries

Adjusting entries are made to align the financial records with accrual accounting principles to ensure all revenues and expenses are recorded in the correct period, even if transactions have yet to occur.

These entries correct possible timing discrepancies that occur during transaction recording. For example, a business may earn revenue or incur expenses in one period but receive or make payments for them in the following period.

Without adjusting entries, the financial statements would either overstate or understate these revenues and expenses, which can misrepresent the financial position on a larger level.

Once the trial balance is prepared, it is reviewed at the end of an accounting period to determine if any adjustments are required. These typically fall into four main categories:

- Accrued Revenue: Revenues earned but not yet recorded because payment hasn’t been received. These are the services provided but have not yet been invoiced.

- Accrued Expenses: Expenses that have been incurred but not recorded because the bill hasn’t been received. These are the utilities used but not yet paid for.

- Deferred Revenue: Cash received in advance for products or services not provided. This needs to be allocated to the period they belong to.

- Prepaid Expenses: Payments made in advance for expenses are recognized gradually as they are incurred. Examples include insurance or rent.

Once necessary adjusting entries are detected, they are posted to the general ledger to update the account balances. Next, an adjusted trial balance is prepared to ensure the books are balanced with equal debits and credits. This final trial balance is then used to prepare financial statements to correctly report revenues and expenses.

Step 7: Preparing Financial Statements

Once the adjusting entries are posted and the adjusted trial balance is generated, the next step is to prepare financial statements to summarize the financial performance and position for the accounting period. These include:

- Income Statement: Shows the company’s revenue and expenses for a period to calculate the net income or loss.

- Balance Sheet: This overviews the financial position at the end of the accounting period regarding assets, liabilities, and shareholders’ equity.

- Statement of Retained Earnings: This shows the fluctuations in retained earnings, factoring in the net income from the income statement and any dividends paid.

- Cash Flow Statement: Reflects the cash inflows and outflows from the operating investing and financing activities.

These statements communicate financial information to investors, management, and creditors to help them make informed decisions about a business. Once these statements are prepared, the books are closed by making closing entries, which resets temporary accounts to zero for the next accounting cycle.

Step 8: Closing the Books

This step officially marks the end of an accounting period and prepares the company for the next cycle by clearing out temporary accounts and transferring the balance into permanent accounts.

The main objective of this step is to reset temporary accounts, which include revenue, expenses, and dividend (or withdrawal) accounts, to zero. These accounts are temporary because they track financial performance over the current period without carrying balances into the next one. This process includes 4 main steps:

- Closing Revenue Accounts: All revenue accounts are debited, and the balance is transferred to the Income Summary account.

- Closing Expense Accounts: All expense accounts are credited and transferred to the Income Summary account.

- Closing Income Summary: The balance of the income summary (representing net income or loss) is transferred to the retained earnings account (permanent equity account on the balance sheet).

- Closing Dividends/Withdrawals: Any dividends or withdrawals are closed directly to the retained earnings account, which reduces the balance.

At this point, net income or loss is transferred to retained earnings, and the temporary accounts are reset to zero for the new fiscal year. This ensures that the financial performance is measured accurately for each year without carrying over balances from the previous year.

In addition, closing entries also help prepare a post-closing trial balance (final trial balance), which records only permanent accounts (assets, liabilities, and equity) since all temporary accounts should now have zero balance. With this step, debit equals credit, and the books are balanced for the following year.

What are the Benefits of an Accounting Cycle?

An accounting cycle helps a business keep its financial position in check at each step in several ways. Some of the benefits are:

Efficiency in Financial Management

One of the main benefits of the accounting cycle is how it enhances efficiency in financial management. This happens because it works as a checklist for every step to break down complex financial records in a structured and sequential manner.

With such a systematic approach to record keeping, the chances of errors come down, and the accounting process becomes more manageable, especially for businesses that don’t have a dedicated accounting team.

Better Compliance

The accounting cycle plays a critical role in ensuring businesses follow federal regulations and tax codes. When every business adheres to a standard system, it produces accurate and consistent financial reports that meet the regulations set by regulatory bodies like the IRS. This reduces the chances of mistakes, which could lead to fines or even audits from the government.

A good example is how businesses can ensure that they report the right amount of taxable income while filing taxes by properly tracking their income and expenses.

Every step in the accounting cycle—from recording transactions to closing the books—ensures that financial data is collected and organized according to standard rules.

This is necessary because it helps you maintain accurate reports, which gives the government a clear picture of your financial health so you can stay compliant with the law and avoid financial troubles.

Financial Performance Measurement

Accounting cycles help business owners carefully track all the incomes and expenses of their business, making it easy to understand the company’s true financial state. Teams can analyze the income statements and understand if the organization is generating profits or incurring losses for a given period.

Measuring financial performance is extremely important because it helps businesses set realistic feature goals. It can help understand if a business is meeting the targets or falling behind by comparing current performance with past periods.

With this data, the management can make better decisions about spending, investing, or cutting costs to adjust their strategies and improve overall profitability.

Decision-Making About Financial Statement Data

When transactions are systematically recorded and organized, management can understand where expenses can be reduced and whether there is enough cash flow to support future investments.

With such reliable and consistent data, it is easy to make smarter decisions about growth strategies, such as expanding operations or cutting costs.

For instance, if the financial statements show that sales have increased but expenses are reducing the profits, management can decide to focus strictly on improving operational efficiency. Similarly, if cash flow is finely balanced, a decision can be made to invest in new capital assets or hire more staff.

Uniformity in Accounting Procedures

Accounting cycles ensure businesses follow the same rules and methods when recording and reporting their financial data. This consistency is necessary because it simplifies comparing financial statements of different companies or the same company over time.

If every business uses the same method to report revenue or expenses, it allows investors, regulatory bodies, and other stakeholders to compare financial performance more accurately across multiple companies.

Uniformity also helps maintain transparency in compliance because when companies stick to common accounting standards like GAAP, their financial statements are easier for everyone to understand. This helps a business show its financial position to the stakeholders and reduce any chances of errors or fraud, as the rules are clear and must be followed by everyone.

Timing of the Accounting Cycle

The timing of the accounting cycle depends on a business’s needs and how often it requires financial reporting. Most companies complete their accounting cycles at the end of each fiscal period, which could be monthly, quarterly, or yearly.

Some businesses choose to close their books each month to regularly analyze their financial health. However, others may focus on quarterly reports, especially publicly traded ones, because the Securities and Exchange Commission (SEC) requires them to submit quarterly financial statements.

The timing of the accounting cycles can also depend on their cost-benefit analysis. Companies may choose how often to close their books based on the balance between the cost of gathering, processing, and analyzing financial data and the advantages of having up-to-date financial information.

For example, monthly reports provide frequent insights but require a lot of resources. Quarterly or yearly reports, on the other hand, save costs but provide less timely insights. Hence, modifying the cycle based on this analysis can help management optimize its resources while ensuring that it meets regulatory requirements and internal financial objectives.

Common Challenges and Solutions

Accounting experts may face several challenges while and after preparing financial records, which can lead to significant troubles for management and external parties. Here are some of the most common accounting challenges and how to solve them.

Data Entry Errors

Data entry errors are quite common in accounting. They happen when incorrect data is entered in the records. Although these errors are usually minor, they often lead to inaccurate records and reports, which can become costly mistakes.

For example, an accountant may mistakenly enter a sale of $500 as $50 (or maybe add an extra zero), meaning both the debit and credit sides will be incorrect. However, this will be hard to detect because the book may still appear balanced regardless.

Such errors can also happen when numbers are accidentally reversed during entry. Typing “78” instead of “87” is a minor mistake due to human oversight or multitasking, but it can lead to major discrepancies in the accounting records.

To minimize and prevent such errors, businesses can adopt the following methods:

- Use accounting software to automate data entry tasks and run checks to detect errors early on.

- Apply double-entry accounting to ensure every transaction is recorded in 2 places (a debit in one account and a credit in another) to keep a natural check and quickly identify discrepancies in the books.

- Established clear, consistent guidelines for data entry and designated specific people to handle these tasks alongside processes for how and when to enter data.

- Restrict access to financial data to only authorized people to reduce accidental and intentional errors.

Misclassified Transactions

Sometimes, financial items end up in the wrong category, making financial statements inaccurate and potentially misleading stakeholders about their financial position. This can make things more complex, especially if these errors are found and need to be fixed during audits or if the financial statements are already published.

Here are some of the steps a business can take to prevent and fix these misclassified transactions:

- Set up strict internal procedures for designated responsibilities among staff.

- Train staff in correctly handling financial data to classify transactions for every category.

- Set up periodic review sessions for financial records and compare them with past data to spot any mistakes.

- Use accounting software to automate the categorization process and set up alerts for unusual entries.

Missing Transactions

These errors happen when entries are not recorded in the financial records. This could be due to human error, software issues, or simply forgetting to enter data. If certain transactions, such as sales or expenses, are not recorded, it could cause unexpected cash shortages or incorrect cash flow forecasts.

This could also mean non-compliance with regulations because businesses need to keep accurate records for tax and legal purposes. If any entry related to this doesn’t exist in the records, it can result in penalties.

To solve such accounting errors, a business can take the following steps:

- Regularly audit to ensure all transactions are accurately recorded.

- Keep accurate and organized records of all transactions with supporting documents.

- If a missing transaction is found, investigate the reason immediately. This involves checking for mistakes or omissions and recording the transaction thoroughly to avoid discrepancies.

- Always cross-check financial entries against original documents to ensure nothing is missing. Organizing documents using software can make these processes easier.

- Regularly compare your internal records with external documents like invoices and bank statements to catch potentially missing entries.

What are the Differences Between the Accounting Cycle and Budget?

The accounting cycle primarily deals with past events, i.e., transactions that have already happened during a specific period. However, the budget cycle is a futuristic concept as it is a part of the planning process for future decisions.

Moreover, the data generated by the accounting cycle is used by external parties like investors, creditors, and regulatory bodies that depend on historical data to make their decisions. On the other hand, the output from the budget cycle is used by internal management (managers and executives) for decision-making in day-to-day operations and strategic planning for the organization.

What is the Difference Between a Journal and a Ledger?

Journals and ledgers are two of the most important documents in which financial transactions are first recorded. A journal is a chronological record of financial transactions, including details like date, accounts involved, amount, description, and the corresponding debit or credit.

Once recorded, these transactions are moved to the ledger, which organizes them by account and not date. Basically, the journal focuses on recording the transaction as it happens, and the ledger summarizes this information according to the nature of the account it belongs to.

Popular Software for Managing Accounting Cycle

Maintaining an accounting cycle takes significant time and is often prone to errors. However, automating this process with accounting software can save a huge chunk of time and effort in accounting processes. Some of these leading solutions are listed below.

Xero

Xero is a specialized cloud-based accounting software primarily suitable for small and medium-sized businesses. It uses AI to provide advanced reporting abilities and offers extensive features like online invoicing, bank reconciliation, multi-currency accounting, and analytics to simplify record-keeping for organizations.

With Xero, you can produce detailed summary reports of transactions belonging to any accounting period. It automatically checks the reports for errors and any discrepancies that may go unseen with manual handling. Users can also customize invoices and set automatic payment reminders for clients, which reduces the hassle of recording and following up on payments.

QuickBooks

QuickBooks is an all-in-one accounting solution for businesses of all sizes and industries to assist with advanced accounting, virtual bookkeeping, payroll, time tracking, and payments. With its online portal, you can track all your transactions, access client files in real-time, and monitor the cost of every project for accurate records.

It automatically runs reports to update the records in real-time and sends alerts to make necessary adjustments. Moreover, it can be easily integrated with banks to get a clear view of finances and transactions. QuickBooks can manage everything from invoicing to billing and setting automatic approval requests for clients for a streamlined workflow.

Sage 50

Sage 50 is an AI-powered accounting solution with comprehensive capabilities that caters to businesses’ simple and complex accounting requirements. It automatically captures financial data such as invoices, receipts, and bank statements using AutoEntry and OCR technology and sends it to customers.

Moreover, it automatically tracks inventory levels, updates stock based on sales, and generates purchase orders when inventory is low for efficient stock management. Based on the financial history, you can also generate real-time financial reports like balance sheets, income statements, and cash flow reports. This automates the entire accounting cycle to reduce the time and possibilities of human errors.

Final Words

An accounting cycle is an essential practice that keeps your financial records in order and up to date. By following all the eight steps discussed in this guide, you can ensure that your books are accurate and ready to help you and your stakeholders make sound business decisions. It is a straightforward process that, when done right, saves you time, reduces stress, and supports better financial management on all levels.