Online payment solutions enable customers to pay for products or services over the Internet securely and quickly. Their core functionalities are a secured payment gateway and faster payment processing.

Online payment providers are crucial for eCommerce businesses and physical stores that offer online payment options. With digital payments expected to hit US$11.55 trillion (according to Statista) in 2024, it comes as no surprise that there are countless options that offer seamless transactions between the buyer and seller.

Choosing the right online payment provider depends on various factors outlined below.

- Payment transaction fees

- eCommerce integration options

- Customer Support

- Analytics

- Payment processing

- Security

Geekflare team has handpicked the best online payment solutions for eCommerce businesses after stumbling across hundreds of payment solutions, which we sorted into sub-categories like ease of use, functionalities, pricing, security, compliance, etc.

- Wise – Best All-in-One Solution

- PayPal – Best for Online Payments and E-commerce

- Venmo – Best for Peer-to-Peer Mobile Payments

- Square – Best for Comprehensive Payment Solutions

- Stripe – Best for Developer-Friendly Payments

- Clover – Best for Excellent POS Hardware

- Braintree – Best for Secure E-commerce Payments

- Authorize.Net – Best for SaaS Businesses Payments

- Elavon – Best for Industry-Based Payments

- Worldpay – Best for Global Payment Services

- Adyen – Best for Cross-Border Payments

- Cybersource – Best for Enterprise Payment Management

- Checkout.com – Best for Multiple Currency Payments

- PayJunction – Best For No Code Integration

- Payline – Best for Virtual Terminal

- Show moreShow less

You can trust Geekflare

Imagine the satisfaction of finding just what you needed. We understand that feeling, too, so we go to great lengths to evaluate freemium, subscribe to the premium plan if required, have a cup of coffee, and test the products to provide unbiased reviews! While we may earn affiliate commissions, our primary focus remains steadfast: delivering unbiased editorial insights, and in-depth reviews. See how we test.

-

Supported Currencies

40

-

Payment Link

Yes

-

Customer Support

Email, Phone

Wise is one of the best payment processing solutions for businesses of all sizes because of its no-cost exchange rates and seamless money transfer. Founded in 2011, Wise serves more than 16 million customers for personal and business use.

Wise for Business lets you send payments to 160 countries and receive from over 40 countries, including Australia, Singapore, the UK, the US, and the UAE.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a transparent pricing structure, which breaks down taxes and exchange rates.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

To enable a secured transfer of funds, Wise leverages various security technologies, including two-factor authentication, anti-fraud protection, vulnerability scans, and real-time funds tracking.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

All the transactions are GDPR-compliant, which means it keeps your data safe and secured.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Integrates seamlessly with various accounting tools like Xero, Quickbooks, FreeAgent, QuickFile etc.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Low & transparent currency exchange rates.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Multi-user access to team members.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Business API to automate workflows, reconcile bank accounts, track transactions, and make payouts.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Payout time is as low as 20 seconds.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

No interest in balances.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Not supported in UAE

Wise Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Fixed | $0.50 to $1 |

| Variable | 0.45% |

-

Supported Curriences

25

-

Payment Link

Yes

-

Customer Support

Phone, Email, Community Forum, Live Chat

PayPal is a veteran e-commerce payment solution that enables the seamless transfer of funds between customers and businesses.

Founded in 1998, this US-based company has 435 million users worldwide and operates in 200 markets offering 25 currencies. The company offers bank-level technology, ensuring secured online and in-person payments.

Customers can connect their bank accounts and credit or debit cards to make online purchases and securely send or receive money.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

PayPal provides payment options for both online businesses and physical stores through digital wallets, credit/debit cards, bank transfer accounts, and QR codes.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers easy-to-read reports that help businesses track their sales and profits over a specific time period.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

User-friendly mobile interface that allows customers to make purchases through smartphones and tablets.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Businesses can set up recurring payments and send invoices over email.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

It takes 3-5 business days to transfer funds from your wallet to your bank account.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

PayPal offers additional security and fraud prevention where customers can file for money-back.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with eCommerce platforms like Shopify and WooCommerce.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Easy to set up and use

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Fraud protection and secured transactions

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

PayPal charges a $20 fee for chargebacks from the buyers.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

International transactions and currency conversions are costly.

PayPal Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 2.29% 9¢ |

| Online | 2.89% 49¢ |

-

Supported Curriences

1

-

Payment Link

No

-

Customer Support

Live Chat, Phone

Venmo is a peer-to-peer mobile payment provider founded in 2009. This online payment provider is owned by PayPal and adopts the same technology as PayPal for quick money transfers.

Users can send money from their credit/debit cards, bank accounts, or Venmo balances. However, the money received is credited to the Venmo balance.

As a subsidiary of PayPal, Venmo boasts a vast user base of 78 million. It facilitates in-store payments via QR codes.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Venmo is a suitable payment app for small merchants and businesses that accept only payments within the US.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Users can create both personal and business profiles and use them to accept payments, engage with their friends and customers, and let them add images to the gallery.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers top-notch security features like fraud protection, dispute settlement, and credit/debit or bank account encryption.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

It usually takes 1–3 days to transfer the funds from the Venmo balance to the bank account.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Offers integration with your mobile app to enable quick payments

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Adds social elements such as likes, comments, and shares to send and receive payments.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Users can buy popular cryptocurrencies like Ethereum, Dogecoin, Bitcoin and more.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Security features like 2FA, PIN codes, and payment encryption are included.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Payments and crypto purchases are public.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Only available for businesses in the US.

Venmo Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 1.9% 10¢ |

| Online | 2.29% 10¢ |

-

Supported Curriences

Major

-

Payment Link

Yes

-

Customer Support

Community Forum, Email, Live Chat

Square is an online payment solution that provides businesses with a full suite of business management tools along with online and in-person payment features. You can also use it to set up your online store to start accepting card payments. It also accepts payments through digital wallets and contactless cards (tap-n-pay).

Founded in 2009, Square currently serves over 4 million small and mid-sized businesses across 8 countries. Along with the online and in-payment options, Square also offers features for payroll, invoicing, banking, inventory, restaurant management, retail inventory, and other software solutions.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Security features like 2FA, user access management, and payment encryption make it suitable for businesses of all sizes.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Supports all versions of Android and Apple devices for mobile payments and macOS for the desktop interface.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

You can either pay the full price for the hardware or pay a monthly fee.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

All transactions are PCI-DSS compliant, so the transactions are secured and encrypted.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

A wide range of hardware, like POS machines, virtual terminals, and card readers, is available at a monthly subscription.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

It offers a wide range of integrations with platforms like QuickBooks, Wix, Jotform, Weebly, WooCommerce, and more.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Built-in software and tools for managing business operations and finance.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Machine-learning anti-fraud support.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

No phone support.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Doesn’t run on Windows devices.

Square Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 2.6% 10¢ |

| Online | 2.9% 30¢ |

| Manually Entered | 3.5% 15¢ |

| Card on File | 3.5% 15¢ |

| ACH Transaction | 1%, minimum $1 |

-

Supported Curriences

135

-

Payment Link

Yes

-

Customer Support

Email, Chat

Stripe is a reliable payment solution that offers an incredible set of features such as pre-built payment forms, payment link generation, online invoicing, and accounting for startups, small businesses, and even Fortune 500 companies. Operating since 2009, Stripe currently serves over 3 million businesses as a payment processor.

For the in-store payments, they have a payment terminal that integrates with a POS hardware and card reader.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Stripe’stransparent payment and customizable features make it a top pick for the online payment provider.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Businesses can create customizable payment UIs with colors that match your brand.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Non-developers can also use APIs to link Stripe to their apps or websites.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

All the payments are AES-256 encrypted and offer PCI DSS compliance as an additional encryption. You can use the Stripe Radar for additional ML-based fraud prevention.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Accepts over 135 currencies, including GBP, AUD, USD, and more.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

One-click checkout and payment forms

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Supports a wide range of payment options, including credit/debit cards, Apple Pay, Bitcoins ACH, Digital wallet, and Google Pay

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Developers can link Stripe with their web apps or mobile apps for payment processing.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Complicated setup and may require the developer’s assistance

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Sluggish customer support

Stripe Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 2.7% 5¢ |

| Online | 2.9% 30¢ |

-

Supported Curriences

Major

-

Payment Link

Yes

-

Customer Support

24/7 Phone Support, Email

Clover is best known as the POS and card reader provider that is popular among small businesses. Most ideal for brick-and-mortar businesses that sell online, this eCommerce payment provider integrates with your existing website or lets you set up and host your online store.

Founded in 2010, Clover operates in over 118 countries, including the UK, USA, Australia, and Germany, and currently serves over six million small merchants. Clover supports online, in-person payments and recurring billing.

It offers flexible features to different business cases: retail, e-commerce, table service restaurants, counter service restaurants, and service-based businesses.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Supports various payment options, including credit and debit cards, mobile payments and even gift cards.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Unified dashboard that provides a central point for managing orders and invoices and tracking inventory and payments.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

All the digital payments are PCI-compliant and offer additional fraud protection management.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers tools for managing and promoting your online businesses through various customer retention and engagement features.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Excellent hardware options such as mobile POS, desktop POS, and virtual terminals.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with 100 third-party tools like Gusto, QuickBooks, WooCommerce, Mailchimp, etc.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

24/7 phone-based support

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Robust fraud protection up to $100,000

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Relatively expensive with hardware and software requirements

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Complex for beginners.

Clover Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 2.3%-2.6% 10¢ |

| Online | 3.5% 10¢ |

-

Supported Curriences

130

-

Payment Link

No

-

Customer Support

Email, Phone

Founded in 2007, Braintree is a global payment provider, especially for eCommerce businesses and retailers. Currently, Braintree serves around 230,000 customers in over 45 countries, including the US, UK, Germany, Australia, and more.

Businesses using Braintree can accept payments through credit and debit cards, as well as through PayPal, Venmo, Apple Pay, and Google Pay. Braintree solely focuses on online payment methods and puts its best set of features into use.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Powerful security and compliance powered by intelligent assessment algorithms.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Supports over 130 currencies, which helps optimize bank rates, offering better conversions.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

There is flat-rate pricing and a small interchange fee.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Compatible with every operating system and supports a multitude of devices.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Offers a Level 1 PCI DSS-compliant security to protect customer data

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Third-party integration options with tools like 3dcart, WooCommerce, BigCommerce, and others.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

API-enabled reporting and analytics features like advanced transaction search, batch summary, and dispute management

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Fraud protection through 3D Secure 2 and tools like AVS and CVV.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

High chargeback fees for international transactions.

Braintree Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Mobile wallets and Card | 2.59% 49¢ |

| Venmo (US only) | 3.49% 49¢ |

| ACH Payments | 0.75% fee up to $5 per transaction |

-

Supported Curriences

Major

-

Payment Link

No

-

Customer Support

24/7 Phone Support, Email, Live Chat

Authorize.net is a Visa-owned payment provider that was founded in early 1996 and currently handles over 430,000 merchants worldwide. Best for SaaS-based small businesses, this online payment solution enables businesses to accept payments through debit and credit cards, Apple Pay, PayPal, and even e-checks.

For in-person payments, Authorize.net offers small businesses a virtual mobile terminal, mobile card reader, and billing tools.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Vast options for accepting in-person, online or recurring payments.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

It lets you set up an instant “buy now” button on your landing page for one-time payments with a seamless checkout experience.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers native mobile app integration through SDKs and APIs. Businesses can also store customer information and improve their experience for recurring ones.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a Level-1 PCI DSS-compliant payment to secure customer information.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

24/7 customer support through online chat and ticket system.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Advanced fraud detection technologies with 13 configurable systems.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Easy payment tracking across multiple payment methods.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Enables the recurring payment options for sellers.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

High chargeback fee up to $25.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Outdated UI.

Authorize.Net Payment Processing Fees

| Payment Type | Fee |

|---|---|

| All-in-one | 2.9% 30¢ |

| eCheck | 0.75% per transaction |

| Payment Gateway | 10¢ daily batch fee 10¢ |

-

Supported Curriences

131

-

Payment Link

No

-

Customer Support

24/7 Phone Support, Email

Founded in 1991, Elavon is the most extensive online payment provider that offers solutions for various industries such as restaurants, travel, healthcare, retail, automobile, and more. It offers a wide range of solutions for in-person and online payments, including POS hardware, contactless payment methods, and virtual terminals.

Elavon serves more than 2 million users in around 36 countries and supports over 131 currencies.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Caters to the needs of businesses of different sizes and tailors to suit the needs of various industry types.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Robust reporting tool that offers actionable data insight and ways to act on them. You can sort the KPIs and use location-specific filters to create detailed reporting.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a range of payment gateways such as Fusebox, CenPOS, and Coverage payment, which may be suitable for different industries.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

The checkout feature lets you add a “buy button” to your website and initiate one-click checkout.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Businesses can customize and optimize their payment solutions with add-ons like ACH, gift cards, and online portals.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

24/7 phone support

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Personalized eCommerce reporting and analytics

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with top eCommerce platforms like WooCommerce, BigCommerce, Ultra Cart, and CubeCart.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

All transactions are encrypted and tokenized through Safe-T technology.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Hardware may cost extra

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Unclear pricing and fees

Elavon Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Card-swipe | 2.6% 10¢ |

| Keyed-in | 3.5% 15¢ |

| Online | 1% 25¢ |

-

Supported Curriences

126

-

Payment Link

Yes

-

Customer Support

24/7 Phone Support, Email

Worldpay is an omnichannel payment provider that provides in-person and online payment services in a range of industries. Previously owned by FIS Global, Worldpay has been in the industry since 1997 and specializes in payment solutions such as stand-alone terminals, mobile terminals, smart terminals, point-of-sale systems, e-commerce platforms, and payment gateways.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Worldpay is the best pick for SMEs that have a large volume of transactions and need quick payment processing.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a range of payment options including virtual and mobile card readers, POS hardware, and three different payment gateways.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

The software also gives access to a dashboard that provides insights into data like card sales, invoices, and settlements. However, this comes at an additional cost.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Security features include 3D Secure and PCI compliance via SaferPayments, which are valued.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Accepts a wide range of payment methods and supports over 126 currencies.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with over 100 POS solutions, PayPal, Oracle, Authorize.net, BigCommerce, and more.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Round-the-clock phone support.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Offers a wide range of add-ons like gift cards, loyalty programs, and virtual terminal

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Lack of transparency in fees

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Customer support needs improvement

-

Supported Curriences

187

-

Payment Link

Yes

-

Customer Support

Phone, Email

Adyen is an international payment processing solution that serves a wide range of businesses and industries, including digital businesses, retail, mobility, hospitality, and food & beverages.

Founded in 2006, Adyen has processed transactions worth $825 million, offering a wide range of digital payment options such as credit cards and debit cards, Apple Pay, Alipay, PayPal, and more.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a unified dashboard that gives insights into various cross-channel payments by connecting your online and offline systems.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

You can embed the payment gateways into their marketplace and web app.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Gives more control over customization by enabling you to build custom payment interfaces and add or remove the elements from the checkout page.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers four different payment integration capabilities: drop-in, components, API, and plugins.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

AI and Ml-based risk assessment and fraud prevention technologies.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Supports various payment processors, including Affirm, Alipay, Amazon Pay, Apple Pay, Cash App Pay, Diners Club, Google Pay, JCB, etc.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

All the transactions are secured through Level 1 PCI DSS, which ensures the confidentiality and integrity of the customer information.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Real-time insights with access to cash flow, chargebacks, profitability, etc.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Limited integration options.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Sluggish support.

Adyen Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Swipe/Tap/Dip | 2.6% 10¢ |

| Keyed-in | 3.5% 15¢ |

| Online | 2.9% 30¢ |

-

Supported Curriences

40

-

Payment Link

No

-

Customer Support

Phone, Email, Online Resources

Cybersource is a pioneer in online payment and fraud management services for medium and large-sized merchants. Operating since 1994, Cybersource operates in more than 190 countries, serving 480,000 businesses worldwide.

Cybersource is ideal for eCommerce businesses and lets you accept various payment forms, including credit and debit cards, bank transfers, digital wallets, and installment payments.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Supports local payment methods and offers a range of regional cards, including Maestro, Hipercard, Carte Bancaire, CartaSi, and Aura.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a range of checkout templates in more than 40 languages, including German, Spanish, Hebrew, etc.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

API integration for various payment gateways and lets you link your wallets to apps.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Most payouts are available in just 30 minutes.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Accepts 40 currencies from over 190 nations

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Security features like fraud protection and risk management powered by Level 1 tokenization and encryption.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with various platforms like WooCommerce, Shopify, and Magento, as well as business systems like CRM, ERP, and others.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Instant checkout capabilities without storing customer information.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

No transparent pricing and fees.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Large-volume transactions incur high fees.

-

Supported Currencies

150

-

Payment Link

Yes

-

Customer Support

Phone, Email

Checkout.com is an end-to-end cloud-based payment provider that operates in more than 150 countries, including Singapore, the USA, the UK, and others. This online payment provider supports a wide range of domestic and international regulations, making it compatible with various regions.

It accepts payments in various modes, such as mobile apps, social media channels, email, and QR codes.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Impressive customizable payment interface that lets you build payment pages.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Users can customize and embed payment collection through links or send customers to its hosted pages.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers regulated payments in different locations and automates the conciliation. The quicker processing of both card transactions and bank transfers is also appreciated.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Supports various local and international currencies that enable local businesses to accept payments efficiently.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Security features like 3D Secure authorization, dispute management support, tokenization, and risk management are included.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Supports various local and international payment methods, including Apple Pay, Google Pay, AliPay, Touch n Go, etc.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Third-party integration with eCommerce platforms such as BigCommerce, Chargebee, Magento, and WooCommerce.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Ability to add or remove elements from your customizable payment interface.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Limited reporting tools

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Not suitable for physical stores with POS requirements.

Checkout.com Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Flat fee with currency conversion | 1.99% |

-

Supported Curriences

1

-

Payment Link

Yes

-

Customer Support

Phone, Email

PayJunction is a no-code payment processing platform that was started back in 2000 and makes it easier for non-developers to integrate payment interfaces into SaaS applications. It offers multi-channel payment processing and a payment gateway feature for small and medium-sized businesses.

Businesses can accept payments through credit/debit cards, ACH transfers, and eChecks.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Offers a smart set of tools like smart terminals, recurring billing, and remote signature tools.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Checkout page customization that customizes checkout pages with colors and optimizes them for desktops, smartphones, and tablets.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Digital receipt option that reduces the chargeback and improves reputation.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

For in-person transactions, it offers a virtual terminal or a contactless card reader that enables physical store payments.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with 80 shopping carts, including Shift4Shop, Magento, WooCommerce, and more.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Native analytics tools that cover sales trends and comparisons over time and card type.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Set up and accept recurring payments weekly, monthly, or a scheduled time period.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Fraud identification and detection are done through the address verification system (AVS) and card verification value (CVV).

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Monthly fee for lower volume orders.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Lacks live chat support.

PayJunction Payment Processing Fees

| Payment Type | Fee |

|---|---|

| Card | 1.49% 15¢ |

| ACH | 0.75% |

-

Supported Curriences

Major

-

Payment Link

No

-

Customer Support

24/7 Phone, Email, Live Chat

$10/month

30-Days FREE Trial

Payline is a holistic payment processing solution that caters to the needs of online businesses and physical establishments. Founded in 2009, Payline offers solutions for startups and Fortune 500 companies, and it serves more than 160 countries.

It offers payment gateway and web solutions for the eCommerce business to provide a streamlined customer experience.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Robust dashboard that offers a centralized location that allows businesses to view reports, key in transactions, customer profiles, and create invoices.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Allows you to integrate with your website in a variety of ways through API and third-party integration with payment gateways like Authorize.net, NMI, CardPointe, etc.

- <img alt="Key feature" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/feature.svg" decoding="async" src="data:image/svg xml,”>

Businesses can accept payments instantly and receive funds within 24 hours.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Includes various security technologies and frameworks like AVV, CVV, rule-based fraud verification and Level-3 data protection.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Integrates with third-party eCommerce platforms like Shopify, WooCommerce, Magento, and API integrations.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Virtual terminal functionality provides seamless options for online and offline payments.

- <img alt="Advantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/pros.svg" decoding="async" src="data:image/svg xml,”>

Fraud and chargeback prevention.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Monthly fees cost extra.

- <img alt="Disadvantage" data-src="https://geekflare.com/cdn-cgi/image/quality=90,gravity=auto,sharpen=1,metadata=none,format=auto,onerror=redirect/wp-content/themes/gf/src/CustomTheme/Theme/Assets/Icons/cons.svg" decoding="async" src="data:image/svg xml,”>

Virtual terminals have an additional charge.

Payline Payment Processing Fees

| Payment Type | Fee |

|---|---|

| In-person | 0.4% 10¢ |

| Online | 0.75% 20¢ |

What is the Importance of Online Payment?

Online payments offer numerous advantages and hold significant importance for both eCommerce platforms and physical stores.

Here are the major importance of online payment solutions.

- Convenience: It provides the convenience of paying from anywhere without visiting banks or standing in queues. It also saves time for the sellers, so they don’t have to waste time printing the bills.

- Global reach: By accepting online payments, businesses extend their reach beyond the local regions. Online payment providers operate across various countries and multiple currencies, enabling businesses to accept payments internationally.

- Variety of payment options: Shoppers can pay through various methods, including credit/debit cards, digital wallets, ACH same-day transfer, and even cryptocurrencies. By offering various payment options, businesses can boost sales and customer retention.

- Low transaction costs: Considering the convenience, online payment solutions have low transaction costs as compared to traditional setups. Merchants can seamlessly set up payment gateways with minimum transactions.

- Credibility: With two-thirds of adults adopting digital payments worldwide, online payment solutions boost credibility and establish an opportunity to establish authority and brand reputation.

How do Businesses use Online Payment?

Businesses use online payment systems to accept payments from customers locally or internationally. There are 4 core ways that business makes use of online payment systems.

- Online Payment Service Providers: These are the most common providers that offer card payments and bank account transfers, fund remittances, and currency exchanges. Examples include PayPal and Stripe.

- ACH transfer: It enables the movement of funds from one account to another within the United States. ACH offers low transaction fees and offers direct deposit without any intermediary. Examples include Gusto and Stax.

- Mobile payments: Mobile payments enable transactions through smartphone devices. Services like Apple Pay, Google Pay, and Samsung Pay make transactions convenient without the need to add card information and enable direct account transfer.

- Digital wallets: Around 54% of small and medium-sized businesses (SMBs) will accept digital wallets in 2024 because of their zero transaction fees, no cost of holding balance, and quick money transfer.

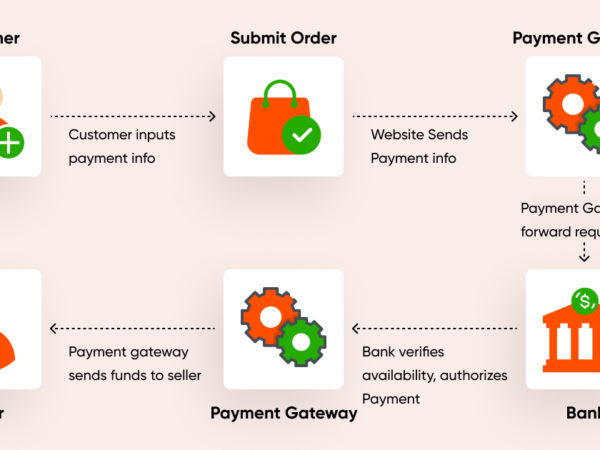

How does Online Payment Services work?

Online payment services work through a series of secure steps that involve multiple parties, including the customer, the merchant, the payment gateway, the merchant bank, and card networks.

Here’s the sequence of steps that the online payment processing follows.

- The customer selects the products or services and proceeds to the checkout page to complete the transaction.

- Next, the customer enters the payment details, including the card information or details required by other payment methods.

- The submitted information is transmitted securely to the payment gateway through encryption and tokenization.

- The payment gateway decrypts the information and sends the payment details and customer information to the merchant’s bank.

- The bank sends an authorization request to the card network (e.g., Visa, Mastercard, American Express) or payment processor.

- The payment processor validates the payment after checking for sufficient funds and verifying payment information and sends it back to the merchant bank.

- The merchant bank relays this detail back to the payment gateway, which informs the merchant.

- After the fund transfer, the merchant initiates the order fulfillment and generates a receipt for the customers.

What are the Types of Payment Gateways?

There are 4 types of eCommerce payment gateways that differ in payment infrastructure, security, and functionalities.

- Hosted Payment Gateway: A hosted payment gateway is a third-party payment provider that saves the business from integrating and getting involved in technicalities. When a customer clicks on the “buy now” button, they’ll be redirected from the checkout page to a third-party PSP (payment service provider) where the customer can make secured transactions. Examples include PayPal.

- API-hosted payment gateway: In this gateway type, customers can proceed to payment without navigating to the third-party payment gateway page. API gateway offers a fully customizable functionality and can be integrated with various mobile devices. For API payment gateway, you’ll need to pay extra for security features like SSL and 2FA. Examples include RazorPay.

- Self-hosted Payment Gateway: Self-hosted gateways, like API, do not redirect customers to third-party pages. However, it offers more customization in terms of branding features and user experience. The transaction process is faster than that of a hosted payment gateway, and the merchant is in full control. Some self-hosted gateways require you to be a bit technical. Examples include Stripe and Shopify.

- Local bank integration gateway: Much like a bank transfer, this payment gateway redirects you from the merchant site to your bank provider’s payment gateway, where you can enter the necessary details and initiate the payment. This is the least used gateway since it requires linking to different baking gateways.

What are the Best Credit Card Processing Companies?

Stripe, Stax, PayPal, and Square are the best credit card processing companies. Stripe is best for transparent pricing, developer-friendly. Stax is best for businesses with high processing volume and integration with QuickBooks, Zapier, etc. PayPal is best for easy to use and accepts alternate payment methods. Square is best for point-of-sale (POS) payments.

What are the other Best Enterprise Software?

Below are some of the other best enterprise software that helps enterprises manage tasks efficiently, automate mundane tasks, eliminate human errors, and increase efficiency.

Salesforce is an e-commerce solution that allows you to create a personalized and seamless omnichannel experience. It provides AI personalization and integration capability with technologies like ERP, OMS, CRM, and marketing automation.

HubSpot Sales Hub is a leading sales software to manage sales pipelines, automate emails and tasks, track emails and calls, accept payments, and manage quotes.

Monday.com is a popular project management software to manage workflows, tasks, and resources to increase productivity and collaboration.

What are the Best Payment Processors?

Stripe, Authorize.net, and Square stand out as the best payment processors. Stripe is best for integration and is developer-friendly. Authorize.net is best to accept a wide range of payments, including credit cards, contactless payments, and eChecks. Square is best for managing POS hardware and software payments.