Geekflare is supported by our audience. We may earn affiliate commissions from buying links on this site.

Investment Banking is the most prestigious and, at the same time, most challenging position.

If you are out there on Wall Street, you will find this profession to be the most valued one. If you are really dedicated to working for long hours, this is a thrilling career path to move forward with.

People have heard the term “investment banking” but don’t really have much idea about it. So, we will demystify investment banking and explain how you can proceed further in this field.

What is Investment Banking?

Investment Banking is a specific division of banking that is related to creating capital for different types of companies and even government entities.

Investment banks help by writing new debt and equity securities to corporations, assisting with mergers and acquisitions, and aiding with securities sales. In short, investment banks come into the picture when large and complicated financial transactions are involved.

Investment banks also provide advice to clients about how much a company is worth and how they can structure the deal. They also help out with necessary documentation for the Securities and Exchange Commission (SEC) required for a company to go public.

This is too much technicality. Let us try to understand the entire concept of investment banking with an example. This example will make it pretty easy for you to get an idea about the process.

Example of Investment Banking

Suppose there’s a company that wishes to go public. The company will get in touch with an investment banker or directly with investment banks to strike a deal.

Analysts at the investment banking firm will evaluate the company and decide on a fair price for their stock, say $25 per share. Then, the investment bank decides to purchase 200,000 shares of the company for the IPO.

The investment bank pays $5 million [200,000 * $25] to the company and completes the paperwork. Later on, they list the share at $28 in the market and start selling them. But, they cannot sell more than 20% of their shares for this price, so they are forced to reduce the price to $24 per share to sell the remaining shares.

The investment bank makes $4.96 million by selling the shares in the market. [{40,000 x $28} {160,000 x $24} = $4,960,000]. But they paid $5 million to the company. So, they incurred a loss of $40,000 in this deal because they overvalued the company’s share price.

This was the scenario only with one investment bank. If multiple investment banks compete for a single company, they will be forced to increase their prices to secure the deal. This might result in a bigger blow to the investment banks. Therefore, arriving at the right price is crucial and challenging in investment banking.

We hope that this example will have made it easy to understand the working of investment banks.

Now, let us understand the role of an investment banker.

What does an Investment Banker do?

Investment banks employ investment Bankers. They help every corporation, government, or other entity to save time and money by managing all the large projects. If there are any risks associated with the project, they will identify them and let the client know about them.

Investment bankers are experts with a complete understanding of the current investing climate. Businesses and companies turn towards investment banks so that they can help them in moving further and developing. Investment bankers will go through the company’s details and tailor perfect recommendations based on market conditions.

Investment bankers help companies raise money for development. If any company wants to go public, they will contact investment bankers for complete management of IPO (Initial Public Offering).

Why is Investment Banking a lucrative career option?

Even if you are at the initial stage of your career, you will get to build large and complex financial models. This will help you with an opportunity to become an expert at what you do. Investment bankers are not always good at investing their own money. But they are more into spending time on evaluations.

Investment bankers are never going out of the market. So, you can consider this to be a stable and always-staying career path. Even if you are a fresh graduate, you can expect an unparalleled salary compared to other professions. You will see financial security pretty soon after getting into this field.

Whatever work investment bankers do is pretty much top secret until publicly announced. So, if you state something, then it is also possible that it makes it to the business section’s front page.

If you are into this field for money, you will definitely get a lot of it. Besides that, a lot of work is also required to get the results. If you are up for long hours, only then should you consider getting into this field.

On average, an investment banker can expect $80,000 per year. The best thing about this career path is that your growth can be exponential with time. So, when you climb up the ladder with experience, you will see that your salary is at an entirely new level! 🤑

So, if you are thinking about starting with investment banking, you should definitely start working towards it.

Now, let us go through the steps for building a successful investment banking career.

How to Start a Career in Investment Banking?

When you are starting out in the field of investment banking, you have to focus on gaining more knowledge. If you have not attained a degree in this field, the best thing for you is the right course.

So, let us look through some of the best courses to learn investment banking.

Essential Career Skills for Investment Banking and Finance [edX]

Whether you are starting out or advancing in your career in Investment Banking, you will find this course extremely useful. You will get to learn about the different sectors and sub-sectors in the entire financial industry.

What you’ll learn:

- Gain insights about various financial institutions

- Learn industry-level financial literacy

- Building your brand and story to support your elevator pitch

This course is taught by instructors who have decades of experience on Wall Street. So, you can expect theoretical and practical knowledge from various backgrounds, including business, mathematics, engineering, economics, and sciences. You will get all the knowledge for beginning your career as an investment banker in this course.

The Complete Investment Banking Course 2022 [Udemy]

The Complete Investment Banking Course is ideal for people starting in this field and wishing to learn everything from scratch. You will be introduced to the four main areas of investment banking in the beginning, including Capital Markets, Asset Management, Trading and Brokerage, and Advisory.

What you’ll learn:

- Building financial models from scratch

- 4 main areas of investment banking with in-depth knowledge of each

- Skills to clear investment banking interviews

This is a complete course on Udemy where you will dive deep into every topic that might come up in an investment banking interview. If you plan to land a job on Wall Street, this course is like a one-stop-shop for all the required knowledge. It is a well-structured course with theoretical as well as practical knowledge.

Investment Management Specialization [Coursera]

This is a 5-course specialization where you will gain an understanding of different investment strategies and how they are designed for reaching financial goals at global levels. You will gain both theoretical and practical knowledge through this course.

What you’ll learn:

- Building and managing client investment portfolio

- Understanding of global markets

- Creating investment plans for meeting long-term investor goals

The course will begin with a basic understanding of the global markets. Later on, you will also gain knowledge about building an investment portfolio of yours and your clients’. Every decision you make in the financial market will depend on future trends, and you will learn how to research in the right direction.

This Skillshare course is an overview of various divisions part of a typical investment bank. Here, you will get a better idea about the working of every division in an investment bank. So, you can expect yourself to approach an interview with more confidence after gaining knowledge about every division in detail.

What you’ll learn:

- Various divisions of investment banks

- Functioning of every division in an investment bank

- Ability to decide your division of working

As it is an entry-level course, you will get to learn about investment banking basics and the working of investment banks. On top of that, you will also find it pretty easy to explain in an interview why you are interested in any particular division in an investment bank.

Free Investment Banking Course [WallStreetMojo]

This is a free certification course provided by WallStreetMojo. The entire course is divided into two parts. The first is the Investment Banking Video Series, and the second is Investment Banking Guides. Before you apply for a job in the field of investment banking, you need to be clear with the basics of this field.

What you’ll learn:

- Overview of Investment Banking, Accounting, and Excel

- Financial Modeling using Excel

- Preparing professional comparable company analysis table

- Understanding Investment Banking charts

You will be able to learn about every term used in investment banking in this free course. The course begins with the basics so that every individual can find it useful and easy to understand.

Introduction to Valuation and Investing [Alison]

Introduction to Valuation and Investing is another free online course that introduces you to the core concepts of valuation and investment. In order to gain a better understanding of the concepts, you will have to first go through the income statements and balance sheets.

Later on, you will also get to learn about the identification of good and bad stocks. On top of that, you will be introduced to various metrics like EBIDTA and EBIT for assessing the risk in any investment.

What you’ll learn:

- Core concepts of valuation and investment

- Identifying good and bad stocks

- Assessing risks in an investment with metrics like EBIT and EBIDTA

- Studying the components of a balance sheet

The course uses simple examples and methods to explain all the core concepts in a better way.

Finance Foundations [LinkedIn Learning]

Finance is always going to exist in the world. The course Finance Foundations is a basic one where you will understand reading balance sheets and even understanding securities and derivatives. If you are entering the field of investment banking, then this course will help out with the basics.

Even if you are not into investment banking, you will find this course valuable because of your knowledge about financing. It includes the concepts of short-term as well as long-term financing.

What you’ll learn?

- Understanding financial statements

- Short-term and long-term financing models

- Knowledge of Securities and Derivatives market

- Personal Financial Planning

Other than that, you will also come across financial reports from companies like Walmart.

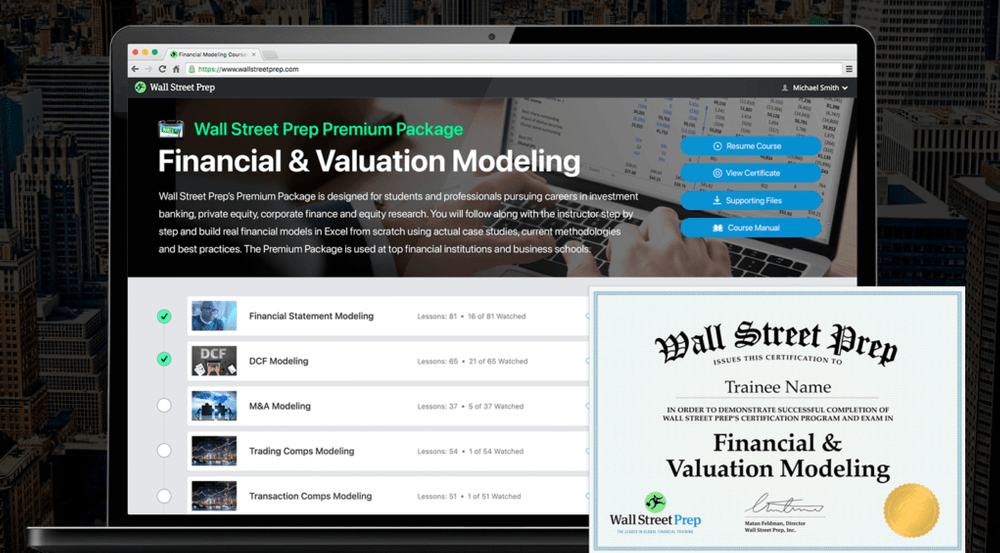

Financial & Valuation Modeling [WallStreetPrep]

If you are looking for an all-inclusive training program before entering the investment banking field, then the Financial & Valuation Modeling training program is the perfect choice for you. This comprehensive training program is often used to train professionals in top investment firms.

Other than this extensive course, you will also receive 38 mini-courses about various topics to clear your basics.

What you’ll learn?

- Building financial models in Excel from scratch

- Learn financial statement, DCF, Comps, LBO, and M&A modeling

- Building buyers list for target companies

As this is a comprehensive course, you need to possess basic introductory knowledge of accounting concepts and be able to work with Excel.

The Investment Banker [Financial Edge]

You can get a Wall Street recognized certificate and upgrade your resume. The Investment Banker is a comprehensive online course that includes 4 different courses and answers to some top investment banking interview questions. So, you can expect yourself to be completely ready after completing this course.

The 4 different courses are – The Accountant, The Modeler, The Valuer, and The Deal Maker. So, you will begin from the basics of investment banking with accounting methodologies to learn the ways to make a deal. You can even add your skills and certificates on LinkedIn to gain better exposure.

What you’ll learn?

- Accounting, financial modeling, valuation, and LBO & M&A analysis.

- Knowledge to crack top investment bank firm interviews

- Understanding to know when a company should go for merger or acquisition and more

Once you have gained the right knowledge through courses, you need to develop certain skills that will help you land a perfect job as an investment banker.

Some skills will be taught to you in the course itself, while some of them have to be developed on your own. If you wish to advance your career as an investment banker completely, you must acquire specific skills.

Skills Required in Investment Banking

Analytical Thinking

Investment bankers need to possess accurate analytical skills for presenting a detailed analysis of investment plans and business ventures. With the right analytical thinking, you will be able to present the risk-return tradeoffs and business plans and back them up with facts and figures.

Communication Skills

The most significant task of an investment banker is to persuade and convince the clients. When you have to sell an idea in the market, you need to possess extreme communication and presentation skills. You need to be fluent and confident enough to convince people in front of you. On top of that, you also need to be good at creating good spreadsheets, presentations, and slideshows.

Networking Skills

Investment bankers need to travel a lot to expand their business and crack deals. This is where they have to make connections with people from different cultures as well as industries. Maintaining healthy relationships with clients and networking with more people is a core skill for investment bankers.

Leadership and Management Skills

Management and leadership skills are extremely important for an investment banker. Even if you are starting as a junior analyst, you will be given the ownership of a business opportunity very soon. You might soon have to handle a complete business segment in any region. So, this is where your leadership skills come in handy.

Entry-level candidates are also required to take responsibility and seek partnerships. When you are good with leadership and management skills, you will see your work getting easier down the line.

These are some valuable skills that will help you boost your career in the investment banking field.

Conclusion 👩🏫

It is better to begin your investment banking career by completing a course and gaining certification. This will provide you with an appropriate boost in finding the right job as an investment banker in top firms. The courses mentioned above will help you out as they are some of the top ones in the market. You may now look at some cool finance apps to manage your wealth and that of your clients.