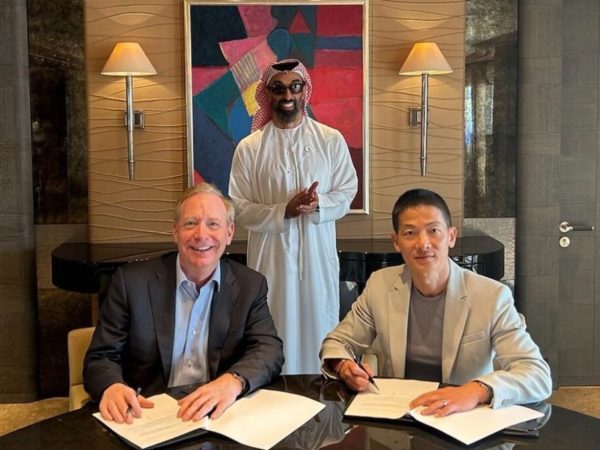

Mastercard has entered a partnership with South African fintech company SAVA, to support micro, small and medium enterprises (MSMEs) through payments technology and infrastructure.

The partnership aims to leverage the strength of both companies to provide small businesses in South Africa, Nigeria, Kenya and Egypt with an online platform that includes digital bank accounts and accounting integration tools to help them manage company expenses

“more efficiently”.

As part of the deal, SAVA will provide businesses with virtual and physical cards with preconfigured budgets that can be managed using the SAVA app. Along with accounting integrations, the firm said its customers will have full control over employee spend, while saving time and money by automating reconciliations.

“Our new collaboration with SAVA represents an important step in our efforts to support small businesses that are key drivers of economic growth,” said Dimitrios Dosis, president, EEMEA, Mastercard.

“By deploying the right, efficient technology we continue to boost financial inclusion in Africa and enable MSMEs to reap the full benefits of the digital economy.”

Johannesburg-based fintech start-up SAVA was founded in 2022 and operates a spend management platform for African businesses through its sponsor bank in South Africa, Access Bank. The company now operates in Kenya and South Africa.

In addition to addressing “pain points” around expense filing and management, SAVA can be used to issue physical cards for shoppers and control spending from a central dashboard, eliminating the need for cash transactions. Moreover, SAVA added that its customers will also be able to manage spending across different platforms accessing an array of financial services.

-

Shruti Khairnar is a seasoned B2B reporter with a diverse background in financial journalism. She has written for prominent B2B publications including FinTech Futures, ESG Investor, Sustainabonds and more.