Dubai-based venture capital firm COTU Ventures has launched its first $54 million fund to invest in early-stage startups in Middle East and North Africa (MENA).

The firm said that while its fund is “sector-agnostic”, it hopes to invest in startups that are in pre-seed or seed stages and is looking to invest between $500,000 to $1.5 million.

Founded in 2021, COTU Ventures’ fund has till date invested in over 20 early-stage companies, with a number of them being tech-related startups. Some of them include UAE-based mortgage platform Huspy, Egyptian fintech startup MoneyHash and UAE-based restech platform Supy, among others.

The new fund’s limited partners include Lunate, Mubadala, Dubai Future District Fund, Arab Bank, Bupa KSA, and general partners from VCs including Foundry Group, Tribe Capital, Stride, and several family offices.

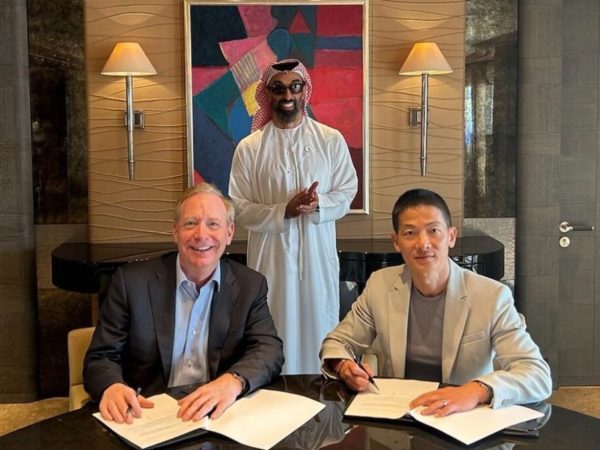

“I’ve been a part of the regional ecosystem since 2008, and it’s come a long way since then,” said Amir Farha, founder and general partner of COTU Ventures.

“Saudi Arabia has opened up internationally, and governments have been driving policies and investment to activate the technology sectors of their local economies. We have a young and growing population of tech-savvy, digitally connected consumers with substantial spending power.

“When you combine all of this with remarkably low customer acquisition costs and some of the highest revenues per user, there has never been a better and more profitable time to invest in the region than today.”

-

Shruti Khairnar is a seasoned B2B reporter with a diverse background in financial journalism. She has written for prominent B2B publications including FinTech Futures, ESG Investor, Sustainabonds and more.